Examining What Drives B2B Buyers to Make a Tech Purchase Buyers looking for tech solutions want vendors who make it easy to understand their options and decide with confidence.

Posted: Mar 6, 2025

B2B tech buyers are a sophisticated and influential group. These decision-makers are responsible for selecting and implementing technology solutions that drive organizational growth and competitiveness. Their strategic choices can significantly impact a company’s bottom line, efficiency, and ability to innovate.

That’s no small responsibility.

Today’s tech buyers are under immense pressure to stay ahead, navigating a sea of options that range from groundbreaking new technologies to tried-and-true solutions. And it’s not just about picking the right tool—they have to weigh costs, scalability, security, and how each solution aligns with their company’s goals.

With digital transformation at the forefront, collaboration across teams like IT, marketing, and finance has become crucial. Together, these stakeholders aren’t just buying technology; they’re investing in their organization’s ability to thrive in a fast-changing world.

For vendors, understanding the unique needs, challenges, and priorities of B2B tech buyers isn’t just a good strategy—it’s essential. The more aligned your marketing and sales efforts are to their reality, the more likely you are to connect with this dynamic and influential audience.

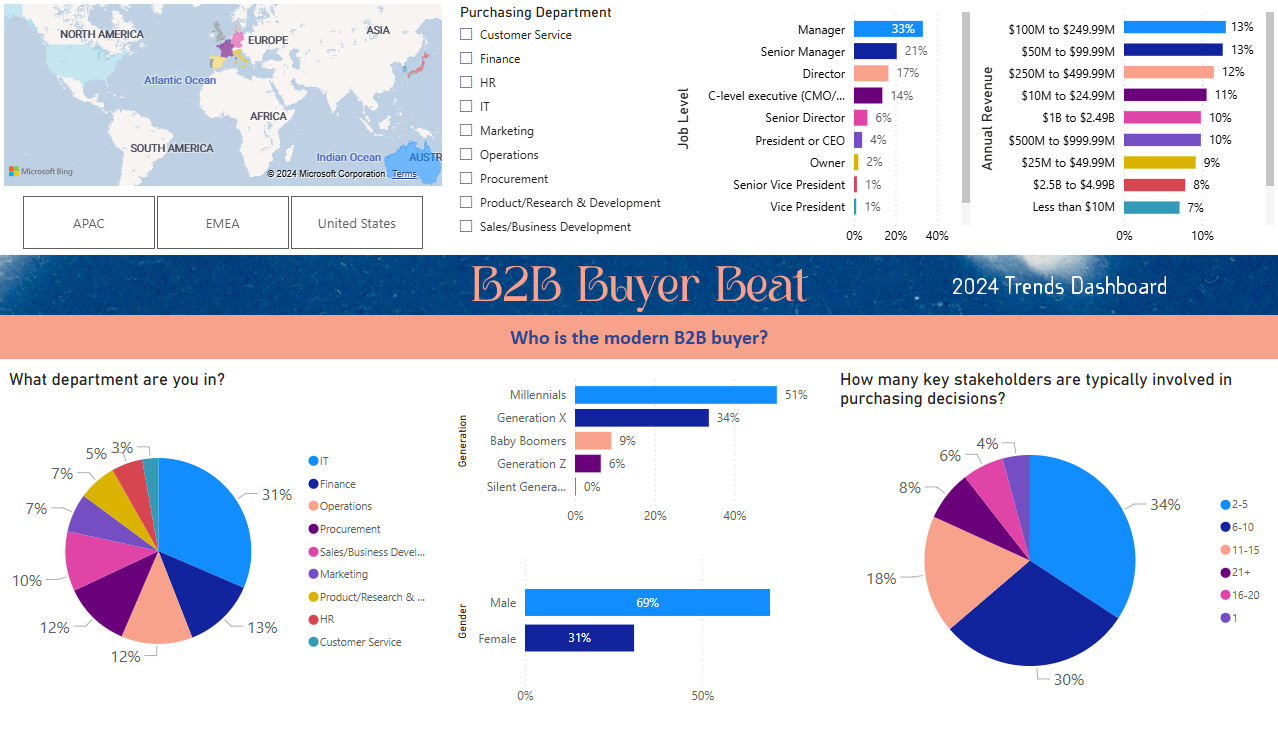

In this blog post, we dive into insights specific to tech buyers revealed in The 2024 B2B Buyer Beat Dashboard, which gathers data from 1,500 B2B decision-makers globally highlighted in the B2B Buyer Beat Insights and Trends report. We're here to uncover the key factors and takeaways on B2B tech buyer behavior.

We asked: What insights can we gather about B2B buyers purchasing tech products?

Executive Summary

- Mid-level managers hold the most decision-making power in the B2B tech purchasing process, with nearly half (48%) holding managerial roles. Millennials also comprise a significant share of these managers, which indicates that they are leading a generational shift that’s transforming and updating the way tech-buying decisions are made.

- Tech buyers typically make swift decisions, with 48% selecting a vendor within 1–3 months, reflecting the industry's fast pace. This quick turnaround is often thanks to smaller decision-making teams—35% report involving just 2 to 5 stakeholders, which keeps things streamlined. Of course, external factors like market shifts and competitive assessments can sometimes slow things down, but those moments are the exception.

- Tech buying decisions are taking longer, with 39% of buyers reporting increased timelines over the past two years. A major factor is the need for brand familiarity, as 44% of buyers require 3–5 interactions with a brand before engaging seriously. These trends reflect a clear shift toward slower, more deliberate purchasing processes.

Tech Marketing Trends & Industry Pathways

- Generative AI (Gen AI) has captured significant attention as organizations worldwide recognize its transformative potential. A recent McKinsey Global Survey reveals that 65% of businesses now regularly implement Gen AI in at least one area of their operations, which is a a substantial increase from just one-third the previous year. This shift indicates a growing acceptance of AI technologies in the workplace.

- Organizations are increasingly focusing on data-driven decision-making thanks to the growing accessibility of data analytics and business intelligence tools. According to research by Forrester, decision-makers at companies with advanced insights-driven capabilities are nearly three times more likely to experience double-digit year-over-year revenue growth compared to those at beginner-level firms.

- Emerging technologies like blockchain and IoT are transforming B2B operations. Blockchain, which is predicted to boost GDP over the next decade by $1.76 trillion, enhances transparency and security in sectors like supply chain and finance, while IoT connects devices, generating data that opens up new opportunities. Together, these technologies are helping businesses gain a competitive edge.

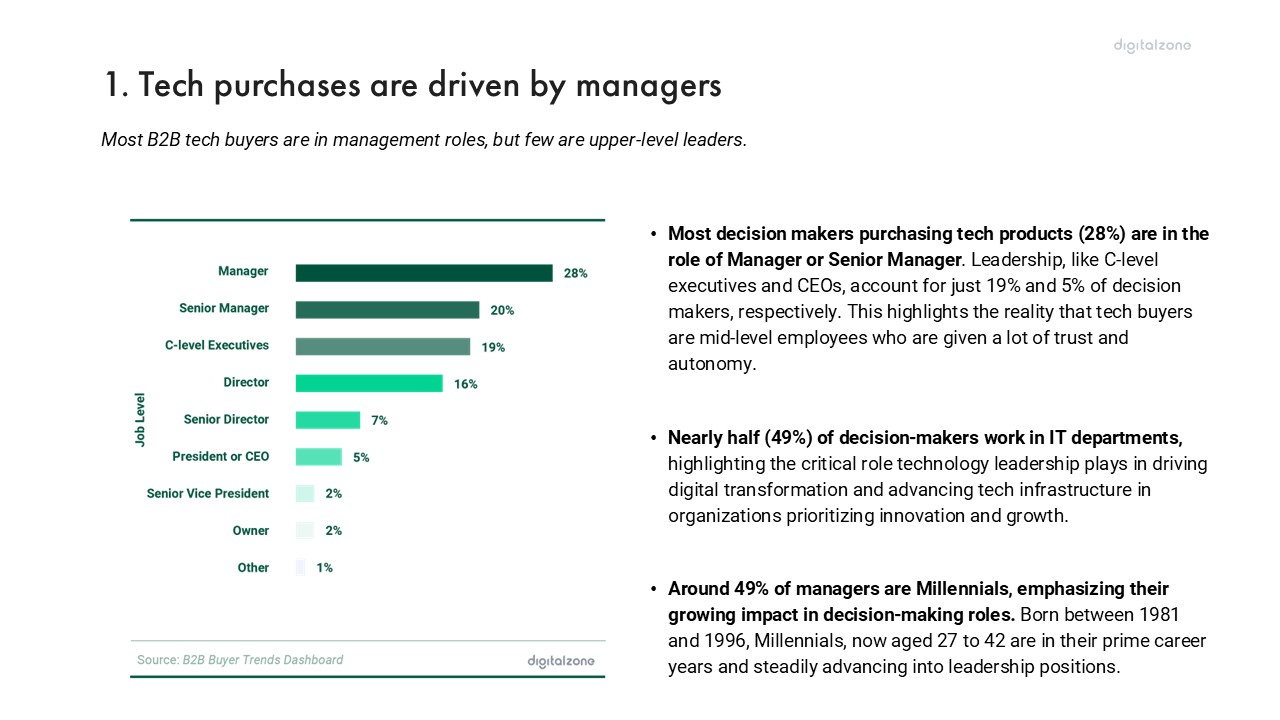

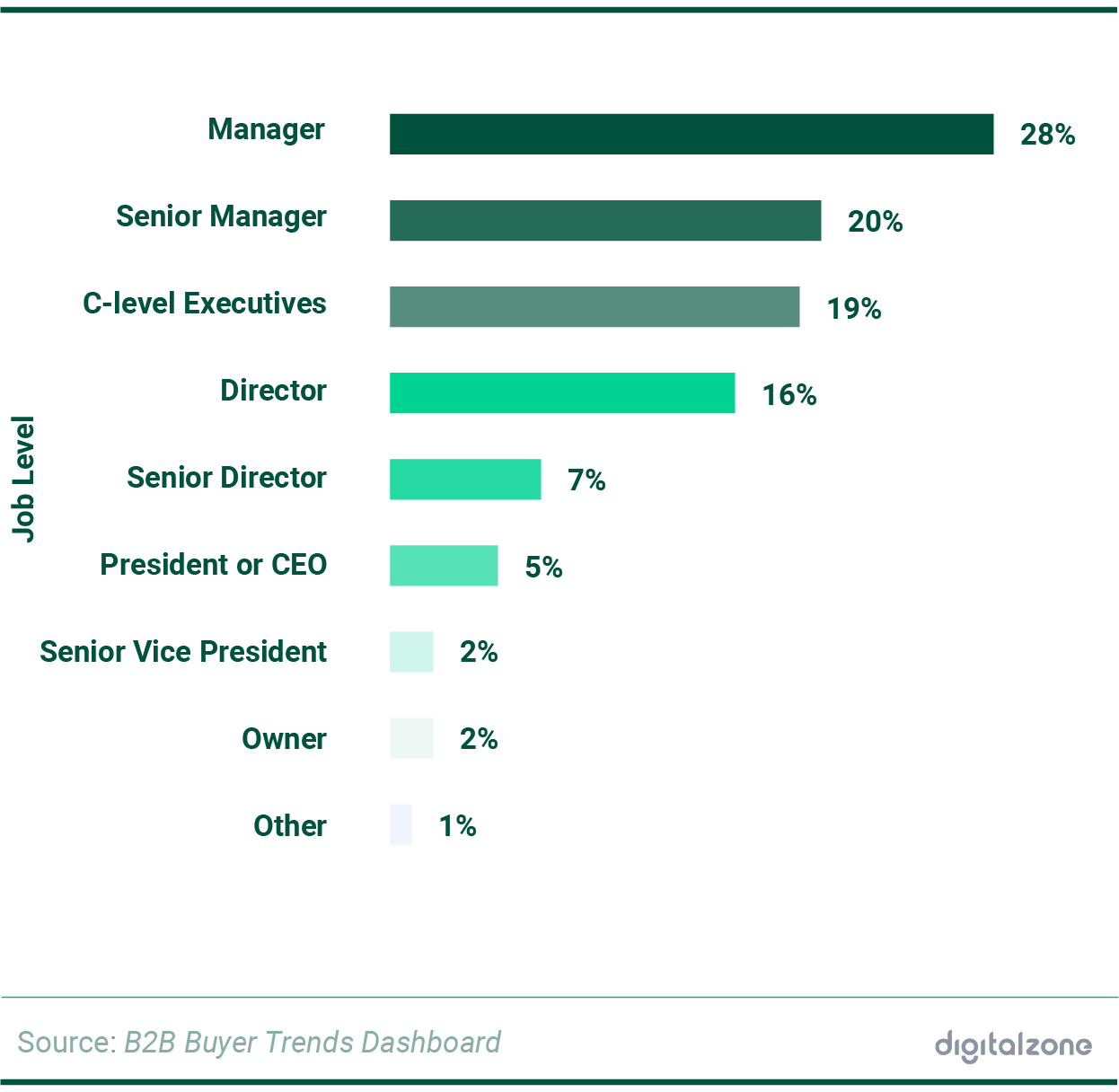

1. Tech purchases are driven by managers

Most B2B tech buyers are in management roles, but few are upper-level leaders.

- Most decision makers purchasing tech products (28%) are in the role of Manager or Senior Manager. Leadership, like C-level executives and CEOs, account for just 19% and 5% of decision makers, respectively. This highlights the reality that tech buyers are mid-level employees who are given a lot of trust and autonomy.

- Nearly half (49%) of decision-makers work in IT departments, highlighting the critical role technology leadership plays in driving digital transformation and advancing tech infrastructure in organizations prioritizing innovation and growth.

- Around 49% of managers are Millennials, emphasizing their growing impact in decision-making roles. Born between 1981 and 1996, Millennials, now aged 27 to 42 are in their prime career years and steadily advancing into leadership positions.

Tech buyers are predominantly mid-level managers, particularly in IT-focused roles or departments, highlighting their authority in the decision-making process.

With nearly half of these managers being Millennials, there is a generational shift toward younger leaders who are likely to prioritize digital transformation and innovative technology solutions.

SFE Partners reports that Millennial buyers engage with digital channels throughout their purchasing journey, like customer portals, marketplaces and channel partner portals. Notably, when factors like price and quality are comparable, 55% of buyers emphasize the importance of the digital buying experience in their vendor choice.

According to Gartner, digital sales channels enable buyers to access information across multiple platforms, allowing them to consume it whenever and however they prefer. These channels include email, virtual events and even free trials.

This underscores how important s is for buyers to have immediate access to the information they need. Therefore, providing a wide range of resources across channels is necessary to ensure that the right message reaches the right buyer at the right time.

Bottom line: Tech buyers, who are largely Millennials, prioritize digital resources and experiences in their vendor selection. They expect companies to deliver information in an accessible and convenient manner by meeting them on the channels where they are consuming content.

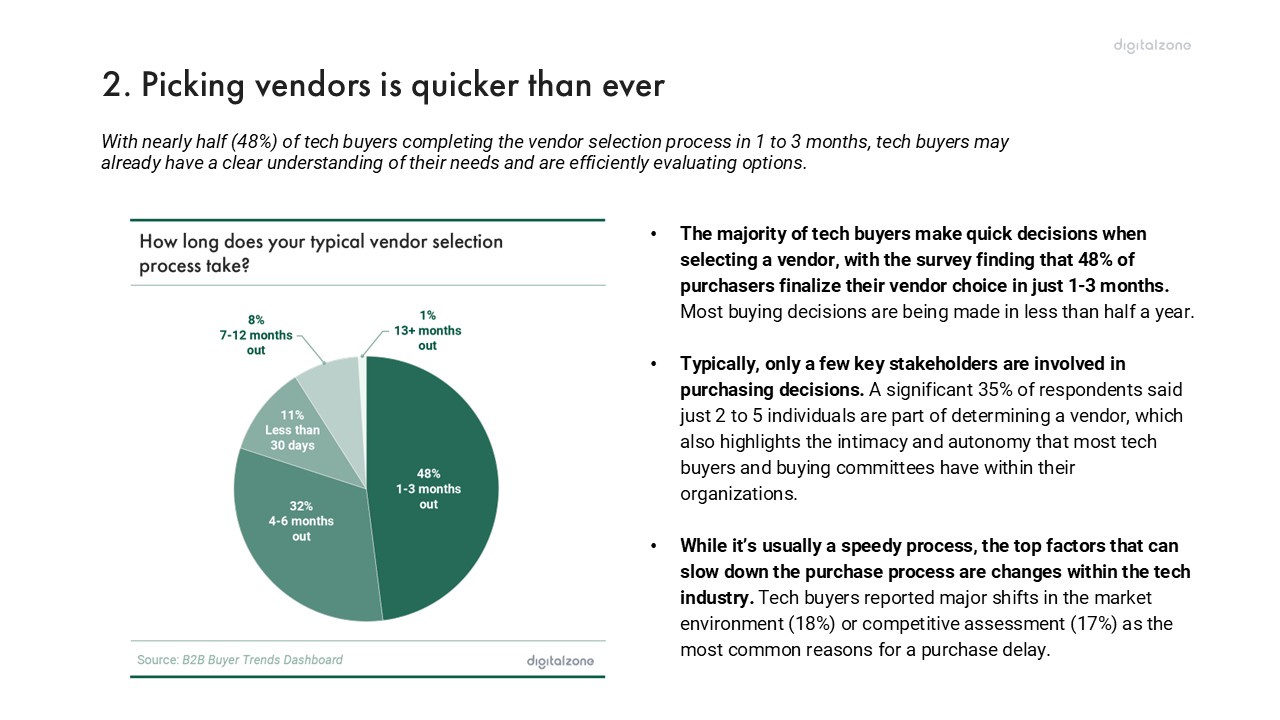

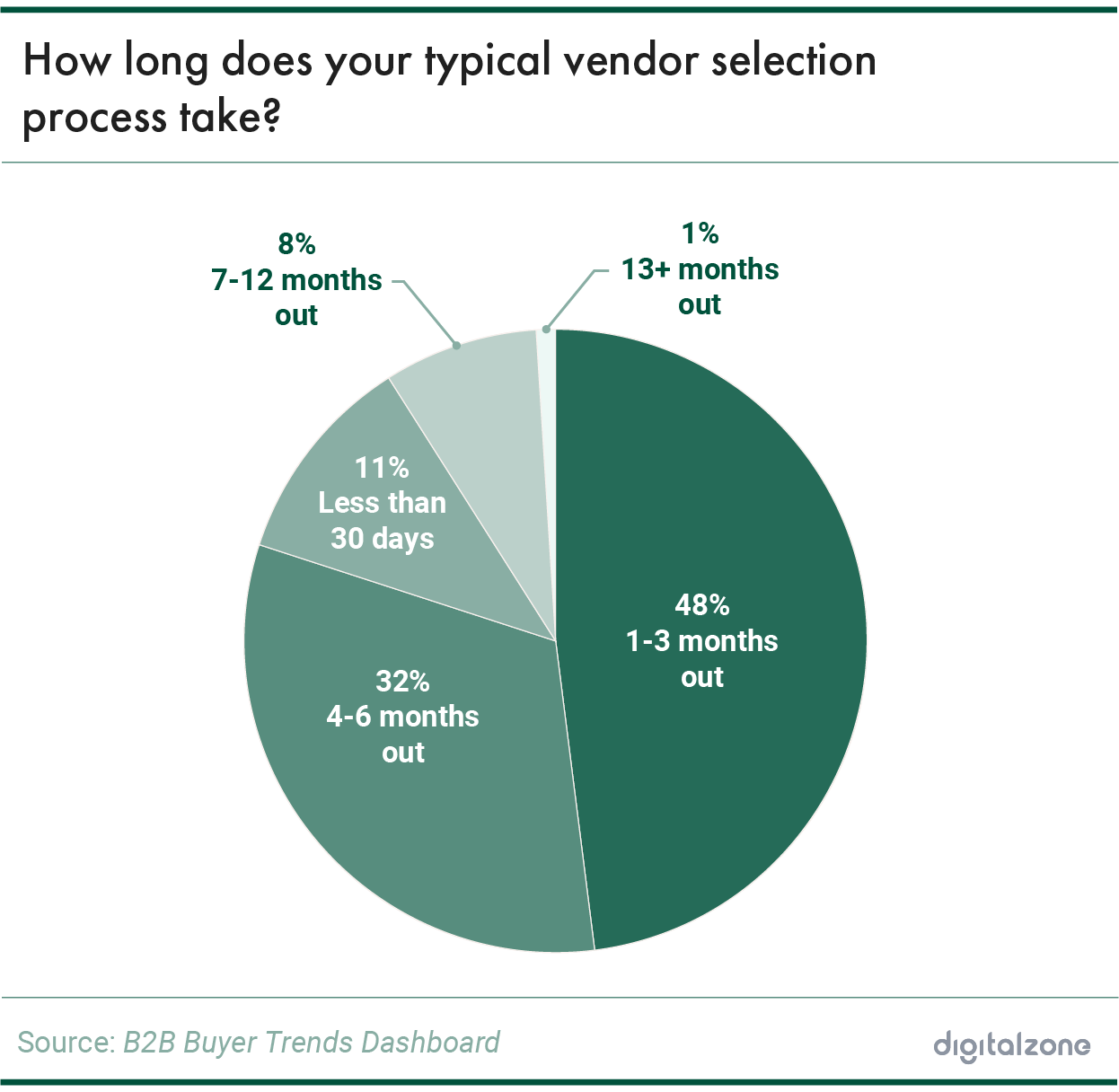

2. Picking vendors is quicker than ever

With nearly half (48%) of tech buyers completing the vendor selection process in 1 to 3 months, tech buyers may already have a clear understanding of their needs and are efficiently evaluating options.

- The majority of tech buyers make quick decisions when selecting a vendor, with the survey finding that 48% of purchasers finalize their vendor choice in just 1-3 months. Most buying decisions are being made in less than half a year.

- Typically, only a few key stakeholders are involved in purchasing decisions. A significant 35% of respondents said just 2 to 5 individuals are part of determining a vendor, which also highlights the intimacy and autonomy that most tech buyers and buying committees have within their organizations.

- While it’s usually a speedy process, the top factors that can slow down the purchase process are changes within the tech industry. Tech buyers reported major shifts in the market environment (18%) or competitive assessment (17%) as the most common reasons for a purchase delay.

Tech buyers lean heavily on their existing technologies by leveraging their familiarity and efficient workflows to make vendor decisions. Their fast-paced roles leave little room for delay, pushing them to quickly adopt new solutions that help maintain their competitive edge.

According to Gartner, 64% of buyers prefer a fully digital buying experience when they are familiar with a product or service. This preference is driven by the speed, convenience and comfort that come with familiarity. For those reasons, they have a strong inclination toward self-guided online research.

But moving through the buying process efficiently requires more than just familiarity—it demands trust. This is where brand awareness and reputation play a critical role. According to Forrester’s Business Trust Survey, 77% of purchase influencers factor in brand awareness when deciding whether to trust a company.

A well-known, reliable brand not only supports faster decision-making but also reassures buyers as they advance through the process with confidence.

Bottom line: B2B buyers who are purchasing tech products or solutions operate in a fast-paced industry where efficiency is key. Their decisions are heavily influenced by familiarity with a technology and a strong sense of brand recognition, enabling them to act quickly and confidently.

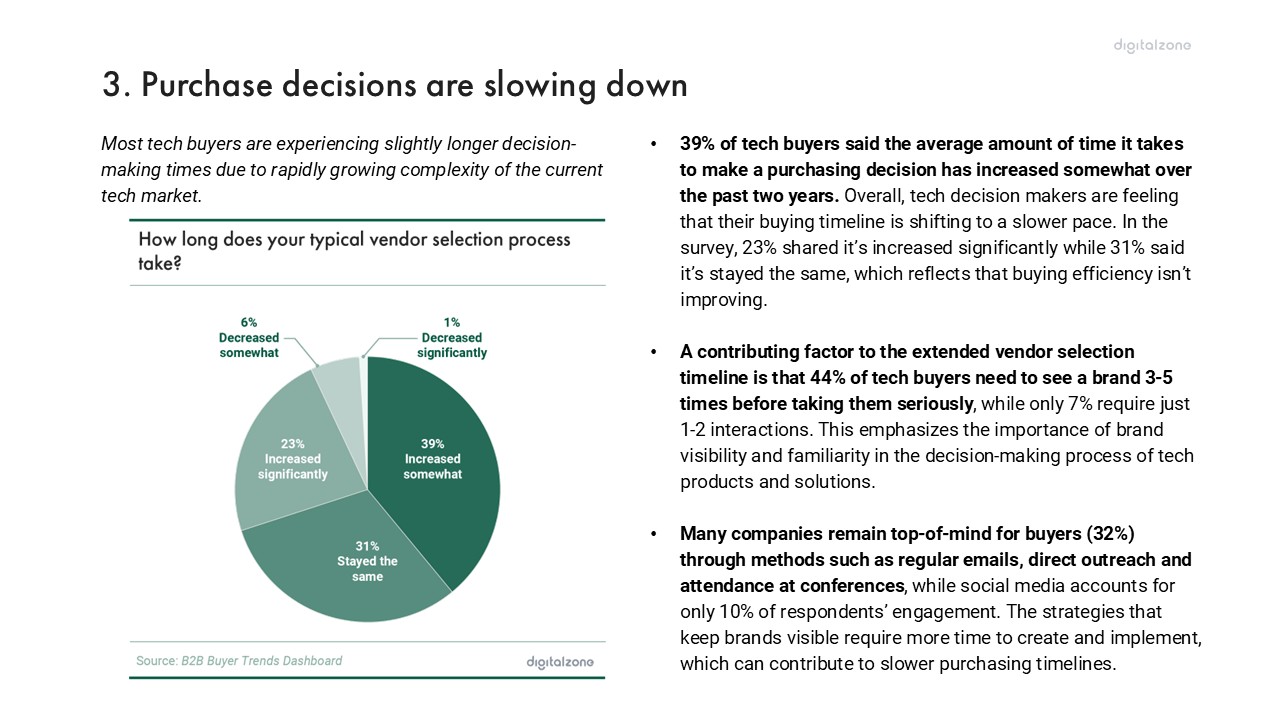

3. Purchase decisions are slowing down

Most tech buyers are experiencing slightly longer decision-making times due to rapidly growing complexity of the current tech market.

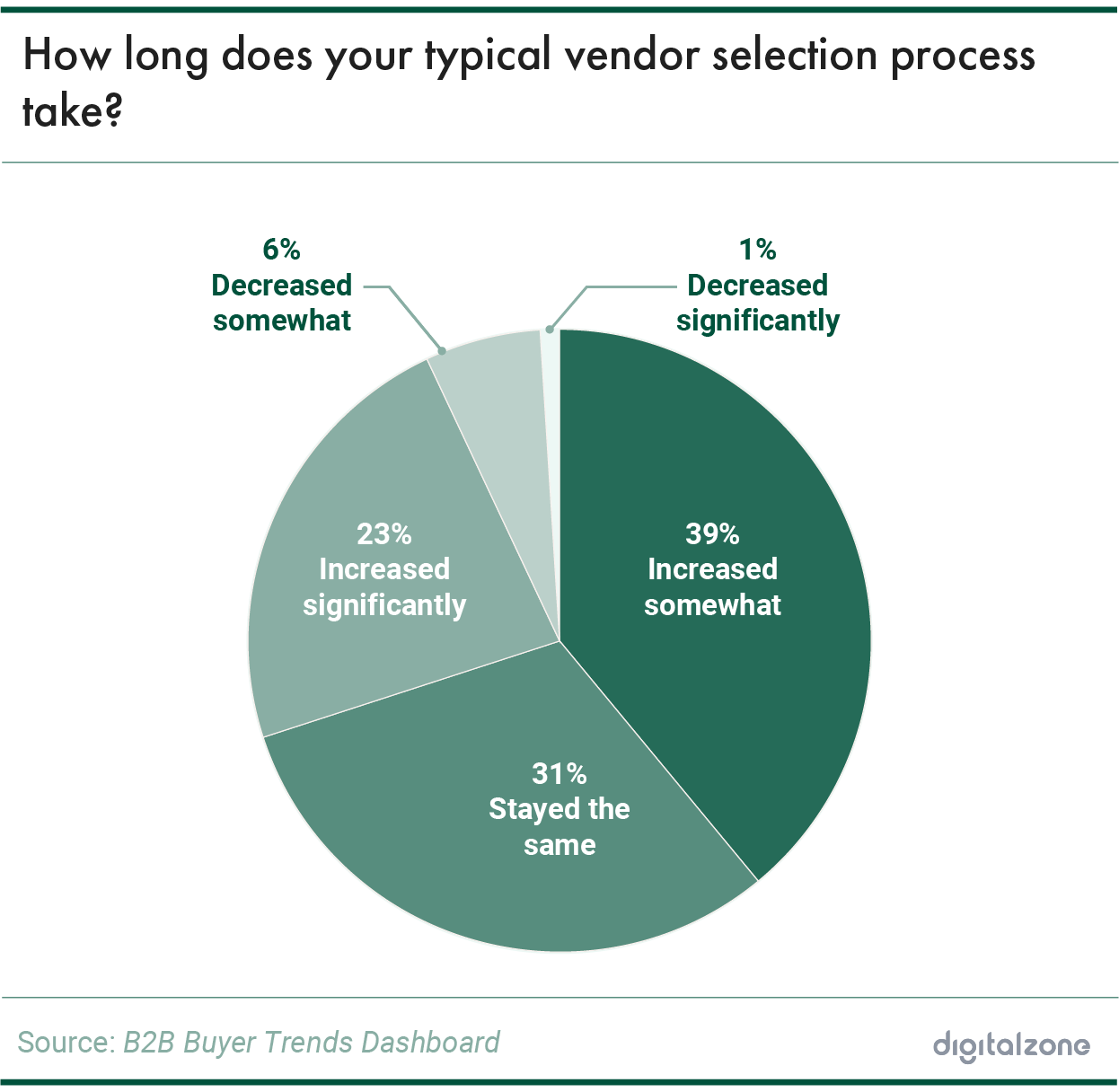

- 39% of tech buyers said the average amount of time it takes to make a purchasing decision has increased somewhat over the past two years. Overall, tech decision makers are feeling that their buying timeline is shifting to a slower pace. In the survey, 23% shared it’s increased significantly while 31% said it’s stayed the same, which reflects that buying efficiency isn’t improving.

- A contributing factor to the extended vendor selection timeline is that 44% of tech buyers need to see a brand 3-5 times before taking them seriously, while only 7% require just 1-2 interactions. This emphasizes the importance of brand visibility and familiarity in the decision-making process of tech products and solutions.

- Many companies remain top-of-mind for buyers (32%) through methods such as regular emails, direct outreach and attendance at conferences, while social media accounts for only 10% of respondents’ engagement. The strategies that keep brands visible require more time to create and implement, which can contribute to slower purchasing timelines.

While choosing a vendor might be a quick decision, finalizing the purchase often takes considerably more time.

According to a recent Gartner survey, 77% of tech buyers describe their purchase experience as overwhelmingly complex or challenging. This complexity comes from navigating an overflow of high-quality information, which can make it daunting to pinpoint the right solution.

Adding to the challenge, 95% of buying groups report revisiting decisions at least once as new insights come to light. This highlights just how crucial clear, streamlined guidance is in helping buyers confidently move forward.

Personalization matters, too. McKinsey & Company found that 71% of consumers expect companies to deliver personalized interactions, and 76% express frustration when this doesn't occur.

By addressing unique needs and pain points, tailored messaging can not only create stronger connections but also foster trust and brand recognition. This approach helps simplify the decision-making process, keeping buyers engaged and ensuring momentum even in a landscape cluttered with information.

Bottom line: Tech buyers are facing increasingly complex purchasing processes, leading to longer decision-making timelines. Companies need to enhance their marketing strategies by providing clear, accessible and personalized information throughout the buyer’s journey.

Final Thoughts

The key insights from The 2024 B2B Buyer Beat Dashboard shed light on the top trends that are shaping buyer behavior in the tech market. As organizations navigate the complexities of digital transformation, understanding these tech buyer trends will be important for both vendors and decision-makers alike.

The shift toward longer decision-making timelines shows that it is essential for companies to enhance their marketing strategies by providing clear, accessible and personalized information throughout the buyer’s journey. With 39% of tech buyers experiencing slower purchasing processes and a significant number requiring multiple interactions for brand familiarity, it’s important for suppliers to adapt their engagement tactics.

By offering valuable insights and simplifying the purchasing experience, vendors can better meet the expectations of tech buyers, particularly Millennials, who dominate decision-making.

When vendors take the time to really address buyer expectations and challenges, they’re not just selling—they’re building trust and creating long-term partnerships. That’s how you turn a complex buying process into a smoother, more rewarding experience for everyone involved.

McKinsey Technology Trends Outlook 2024 — McKinsey & Company

Blockchain technologies could boost the global economy US$1.76 trillion by 2030 — PwC

Data-Driven Insights And AI: Informing And Automating Complex Decisions — Forrester

Executive Summary

-

Mid-level managers hold the most decision-making power in the B2B tech purchasing process, with nearly half (48%) holding managerial roles. Millennials also comprise a significant share of these managers, which indicates that they are leading a generational shift that’s transforming and updating the way tech-buying decisions are made.

-

Tech buyers typically make swift decisions, with 48% selecting a vendor within 1–3 months, reflecting the industry's fast pace. This quick turnaround is often thanks to smaller decision-making teams—35% report involving just 2 to 5 stakeholders, which keeps things streamlined. Of course, external factors like market shifts and competitive assessments can sometimes slow things down, but those moments are the exception.

-

Tech buying decisions are taking longer, with 39% of buyers reporting increased timelines over the past two years. A major factor is the need for brand familiarity, as 44% of buyers require 3–5 interactions with a brand before engaging seriously. These trends reflect a clear shift toward slower, more deliberate purchasing processes.