Beyond Buzzwords: Demand Gen Unplugged for Financial Services

Posted: Aug 5, 2024

The financial services industry is a diverse mix of businesses, offerings, and tools focused on monetary transactions for both retail and commercial use, covering everything from digital banking to fintech.

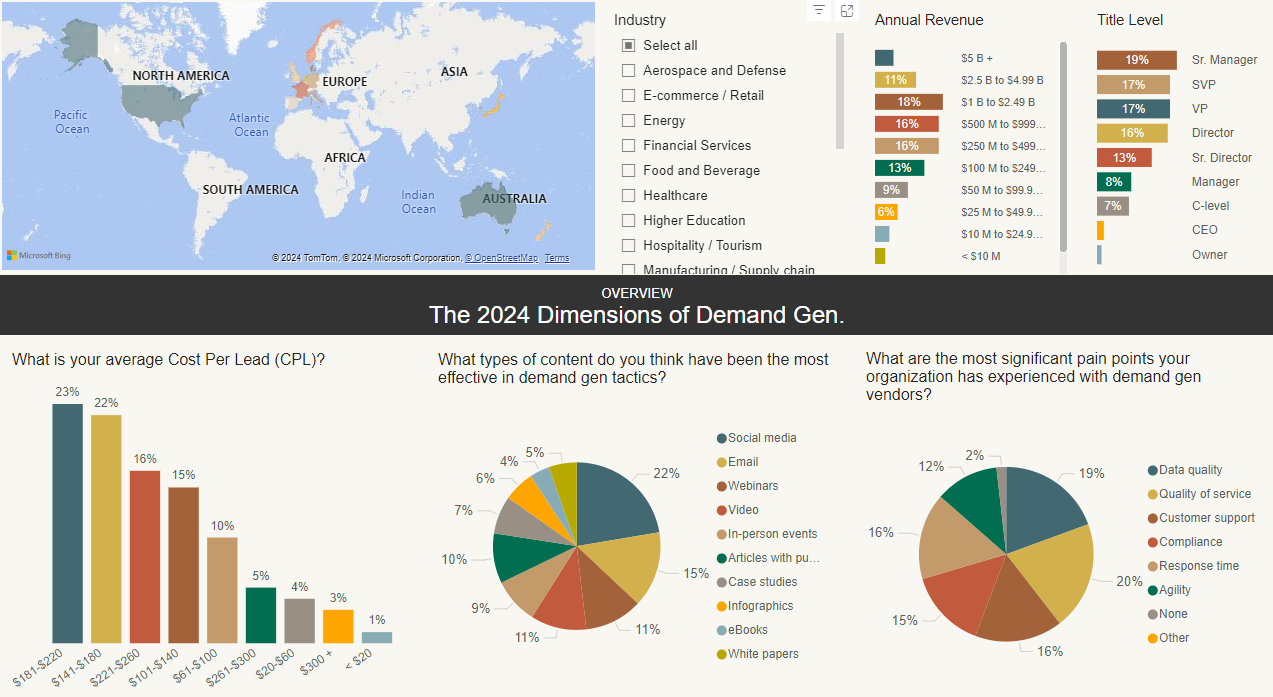

In this blog post, we'll share insights from our 2024 State of Demand Gen Dashboard, which aggregates responses from 1,500 B2B marketers worldwide. Through this data, we aim to illuminate the key drivers and trends shaping demand gen in financial services.

We asked: What are the leading demand gen strategies and perspectives for marketers in financial services?

Executive Summary

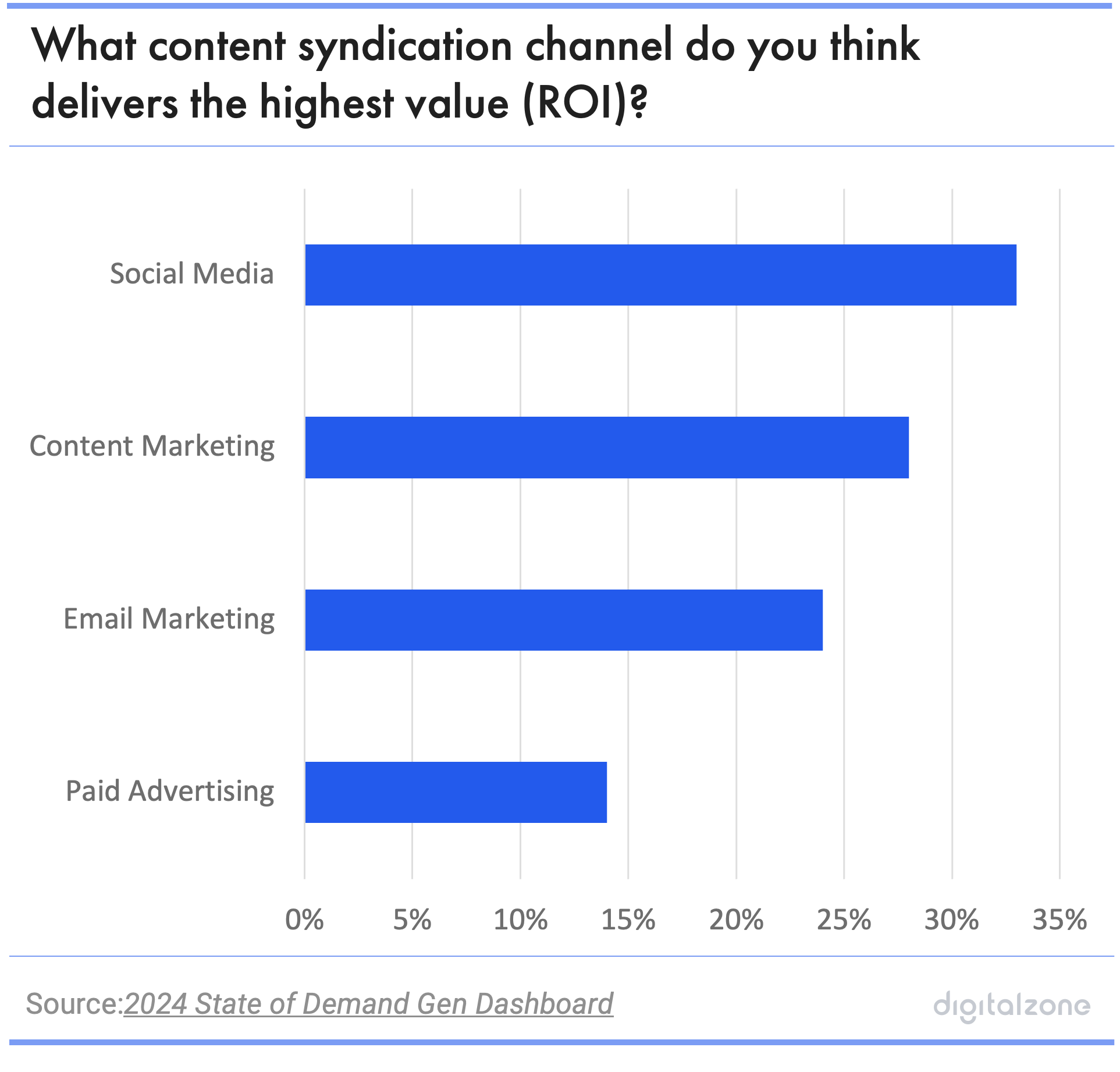

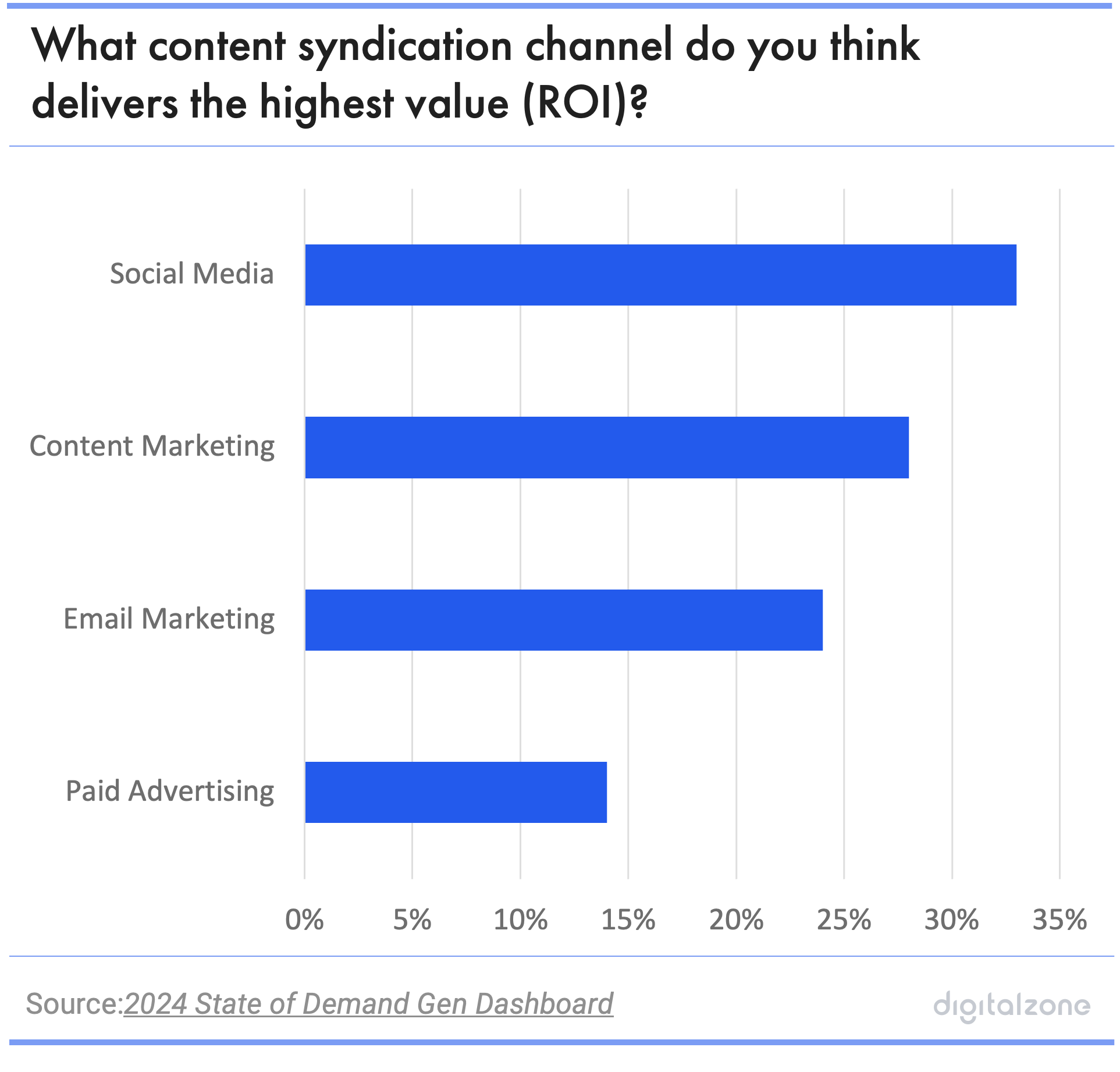

- Marketers in financial services are increasingly focusing on brand awareness, particularly through social media and content marketing, due to their superior ROI. This trend is clear, with 33% of marketers naming social media as their primary content syndication channel and 28% favoring content marketing. Both strategies play crucial roles in nurturing programs aimed at enhancing brand awareness and improving data quality. Additionally, with 23% of financial services marketers expanding the number of channels to optimize ROI, it's evident that brand awareness remains a top focus.

- As brand awareness campaigns proliferate, the volume of data collected is ballooning, necessitating a strategic overhaul in data optimization. The financial services sector exemplifies this need, as businesses increasingly rely on advanced data analytics to stay competitive. With a notable 82% of financial services marketers leveraging automation for data analysis and 85% using sophisticated tools to create personalized content for their target audiences, industry leaders must address the ongoing skills gap or embrace the capabilities of artificial intelligence (AI) to fully capitalize on these opportunities.

- Despite an impressive 90% adoption rate of nurture programs within the financial services sector, limited resources are preventing these initiatives from reaching their full potential. The industry faces significant resource constraints that impede the development and execution of more robust nurture campaigns. To overcome these challenges and fully capitalize on nurture strategies, there is a pressing need for better resource allocation and enhanced efficiency in campaign management.

Financial Services: Current Marketing Trends & Future Industry Directions

- The financial services market is set to skyrocket to an impressive $37,484 billion by 2027. As a result of this rapid growth, we can expect to see more businesses adopt cutting-edge technologies and develop more innovations to stay competitive.

- Financial technology firms are mainly concentrated in the U.S. and China, with eight of the ten largest fintech firms as of January 2024 hailing from these countries. High-value fintech unicorns, valued at over one billion dollars, are most found in the U.S. and U.K.

- Among the financial services marketers surveyed, 29% hold Director titles and 20% are VPs. This substantial representation underscores a significant presence of upper-echelon management and departmental leaders within the marketing ranks.

- Sky-high interest rates, rising regulatory pressure, and persistent inflation (even if it might ease a bit) are shaking up the financial services industry, keeping professionals on their toes in 2024.

1. Financial Services is Boosting Brand Awareness Through Demand Gen

Marketers in the financial industry are leveraging demand generation to amplify brand awareness, turning to social media and content marketing to achieve their goals.

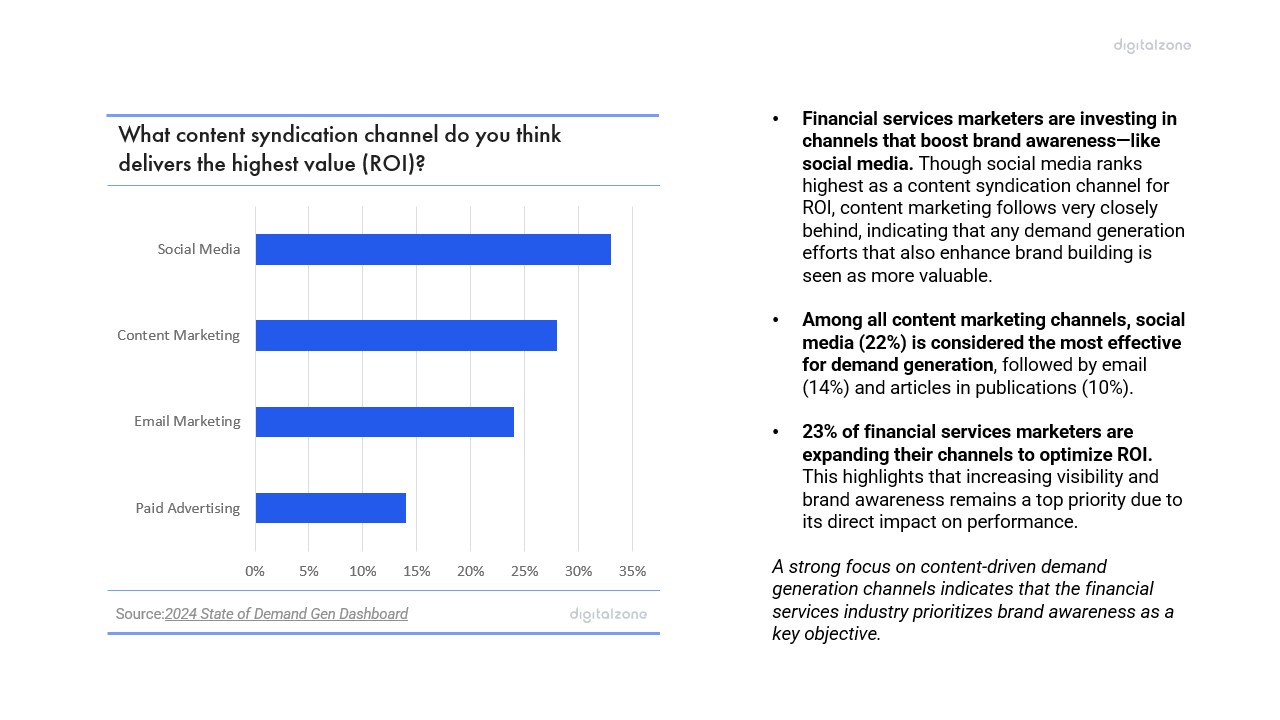

- Financial services marketers are investing in channels that boost brand awareness—like social media. Though social media ranks highest as a content syndication channel for ROI, content marketing follows very closely behind, indicating that any demand generation efforts that also enhance brand building is seen as more valuable.

- Among all content marketing channels, social media (22%) is considered the most effective for demand generation, followed by email (14%) and articles in publications (10%).

- 23% of financial services marketers are expanding their channels to optimize ROI. This highlights that increasing visibility and brand awareness remains a top priority due to its direct impact on performance.

A strong focus on content-driven demand generation channels indicates that the financial services industry prioritizes brand awareness as a key objective.

For example, personal finance management (PFM) platforms, such as mobile banking and digital wealth management services, hold a significant portion of the financial services market. These tools have become popular among tech-savvy Millennials and Gen Z, who adopted mobile finance apps during the pandemic and continue to use them.

A study conducted by Chase also found that 99% of Gen Z and 98% of Millennials use mobile banking apps for tasks like monitoring balances, tracking credit scores, and depositing checks.

As PFMs become a staple in personal finance, corporate financial services are evolving and bringing similar features to their B2B services. The same consumers using mobile banking apps personally now expect the same convenience from commercial banking apps.

Another survey by Forbes and Prolific highlighted that 79% of Millennials and Gen Z have sought financial advice from social media, with 50% reporting financial gains from such advice. This emphasizes that boosting brand awareness through social media is an effective strategy to connect with many financial services audiences.

Supporting this, PWC research emphasizes the significance of brand awareness in business success, showing that companies with a strong brand image outperform their competitors by 25%.

Bottom line: For marketers in financial services, demand generation efforts like social media and content marketing are seen as doubly effective in increasing brand visibility.

2. Data Management Tops the Demand Gen To-Do List for Financial Services

In the finance industry, social media (33%) and content marketing (28%) are nearly head-to-head in perceived value, whereas higher education marketers find social media (34%) and paid advertising (31%) almost equally effective for ROI. This is in stark contrast to IT services marketers, who overwhelmingly favor social media (47%) with no close second.

It’s a clear conversion winner, with Advertising Age reporting 86% of IT product buyers use social media to make purchase decisions.

Bottom line: Social media holds a unique advantage for marketing IT services.

Several Aspects of Data Have Room to Improve

Data optimization needs a makeover as more industry marketers continue growing their data collection through demand gen campaigns with no clear solution for managing it.

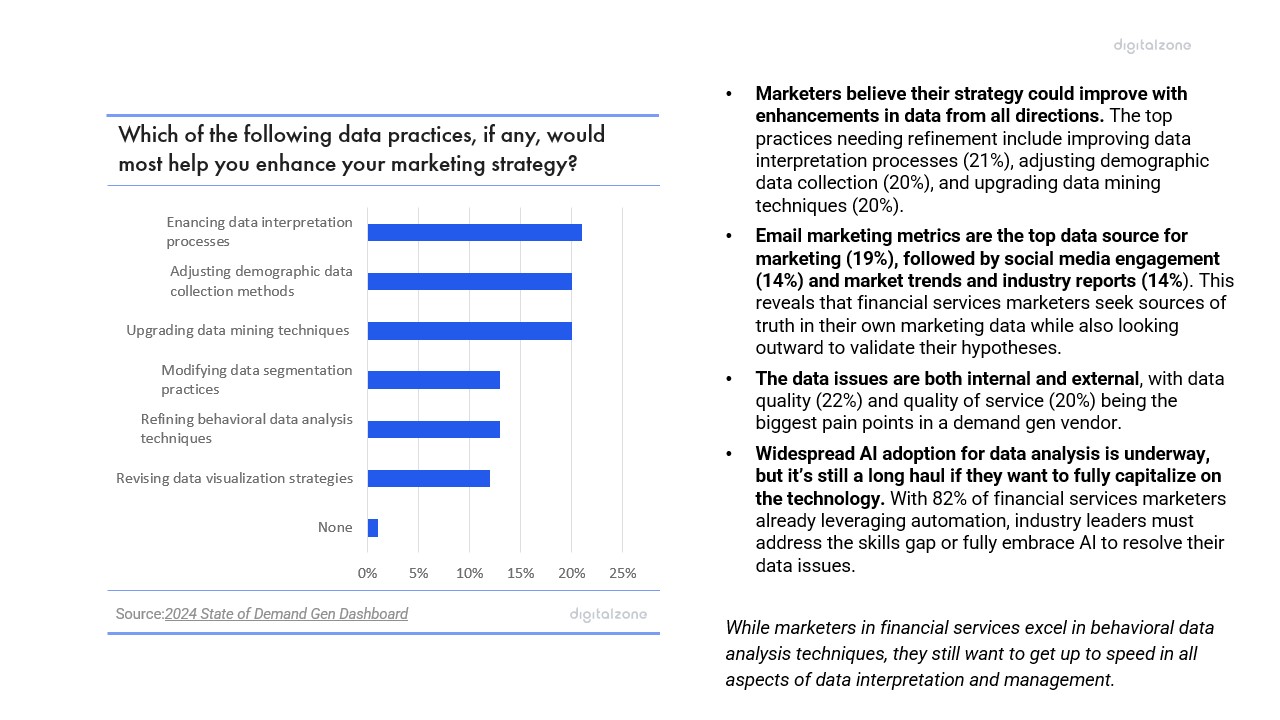

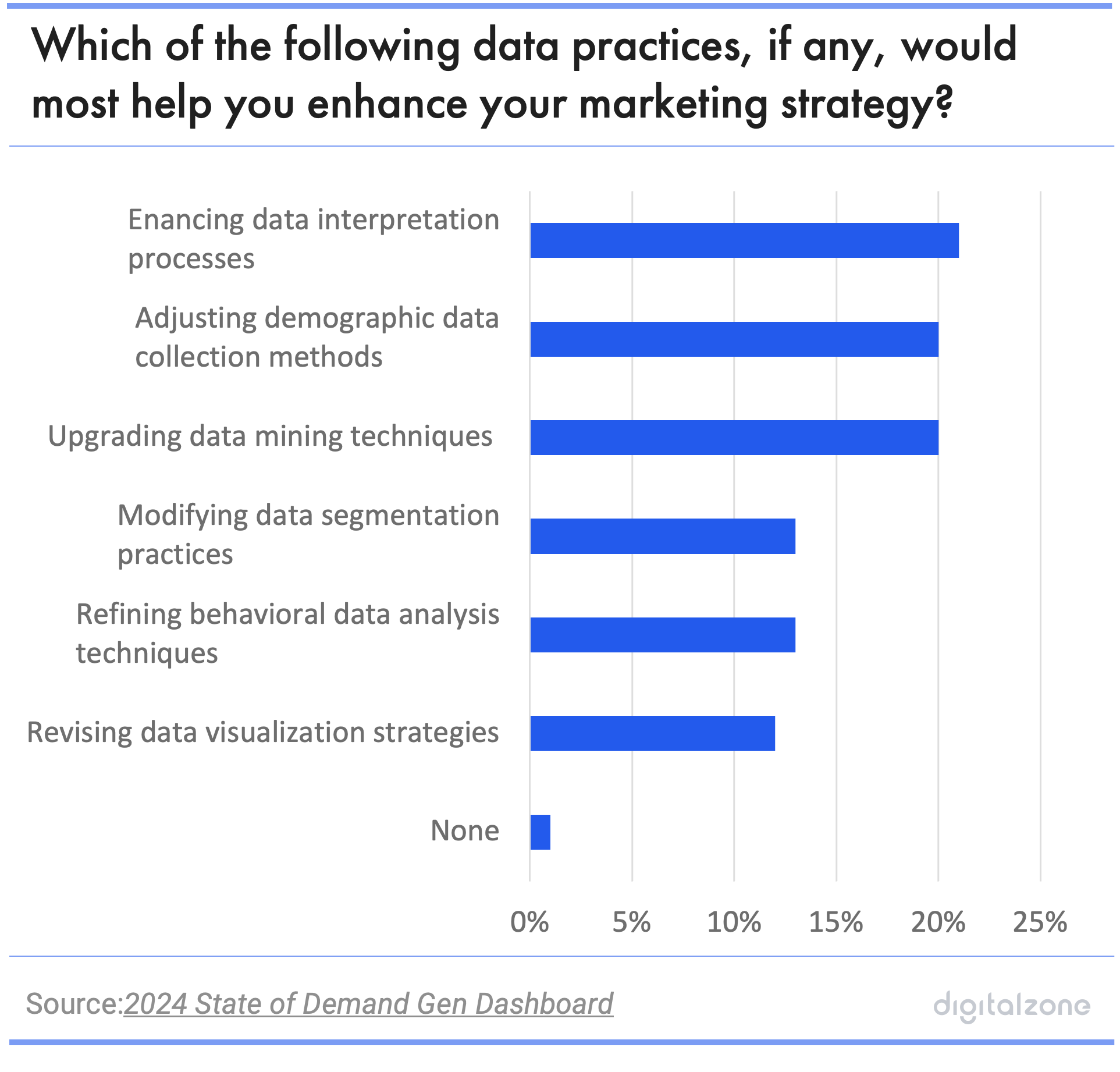

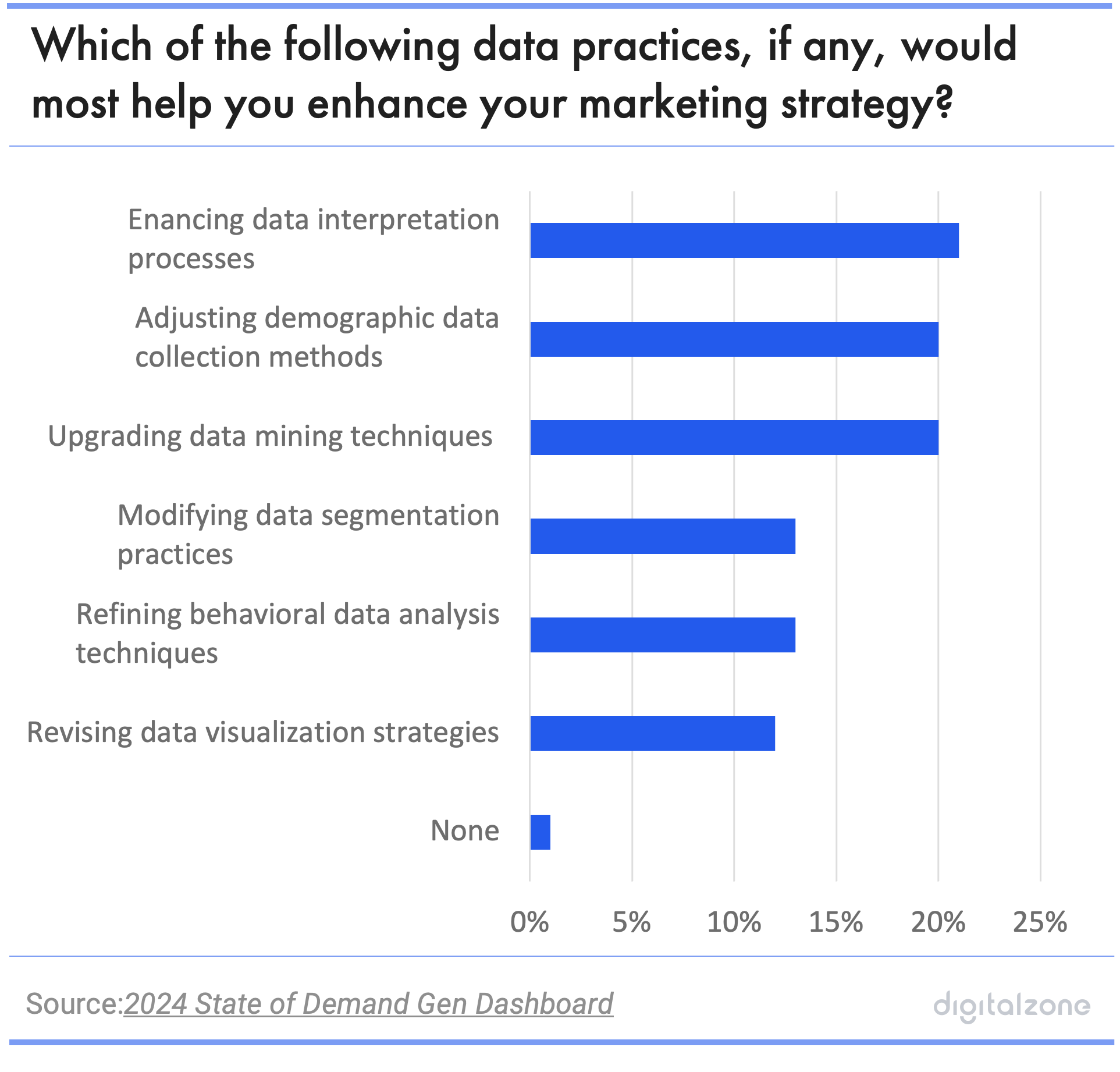

- Marketers believe their strategy could improve with enhancements in data from all directions. The top practices needing refinement include improving data interpretation processes (21%), adjusting demographic data collection (20%), and upgrading data mining techniques (20%).

- Email marketing metrics are the top data source for marketing (19%), followed by social media engagement (14%) and market trends and industry reports (14%). This reveals that financial services marketers seek sources of truth in their own marketing data while also looking outward to validate their hypotheses.

- The data issues are both internal and external, with data quality (22%) and quality of service (20%) being the biggest pain points in a demand gen vendor.

- Widespread AI adoption for data analysis is underway, but it’s still a long haul if they want to fully capitalize on the technology. With 82% of financial services marketers already leveraging automation, industry leaders must address the skills gap or fully embrace AI to resolve their data issues.

While marketers in financial services excel in behavioral data analysis techniques, they still want to get up to speed in all aspects of data interpretation and management.

The financial services landscape is expanding thanks to rapid advancements in technology. However, it is increasingly critical for businesses to consider how both individuals and organizations receive their messages and engage with their services. Consumers want to feel understood and demand that any business service technology actively meets their needs.

In fact, 63% of people expect brands to use their purchase history to offer personalized experiences, and this expectation extends to the financial services sector.

As personal financial management platforms and consumer finance services (such as credit card leaders) increasingly rely on technology like apps, email, and websites to connect with their customers, getting personalization data right is vital. Since most financial activities occur through apps or websites via a login, precise personalization has become indispensable in the finance sector for creating a streamlined user experience and providing accurate service recommendations.

But more data, more problems. The use of data in creating and targeting financial services marketing campaigns is growing, despite 40% of financial services professionals believing they don’t have the tools to implement data-driven digital marketing.

Bottom line: For marketers in the financial services industry, the need for data is rapidly expanding—making it crucial to harvest and harness for staying relevant with audiences.

3. Financial Services Embrace Nurture Strategies but Struggle with Sustainability

The digital boom in financial services demands nimble, savvy demand gen strategies that prove their worth amid shifting markets and fickle consumer expectations.

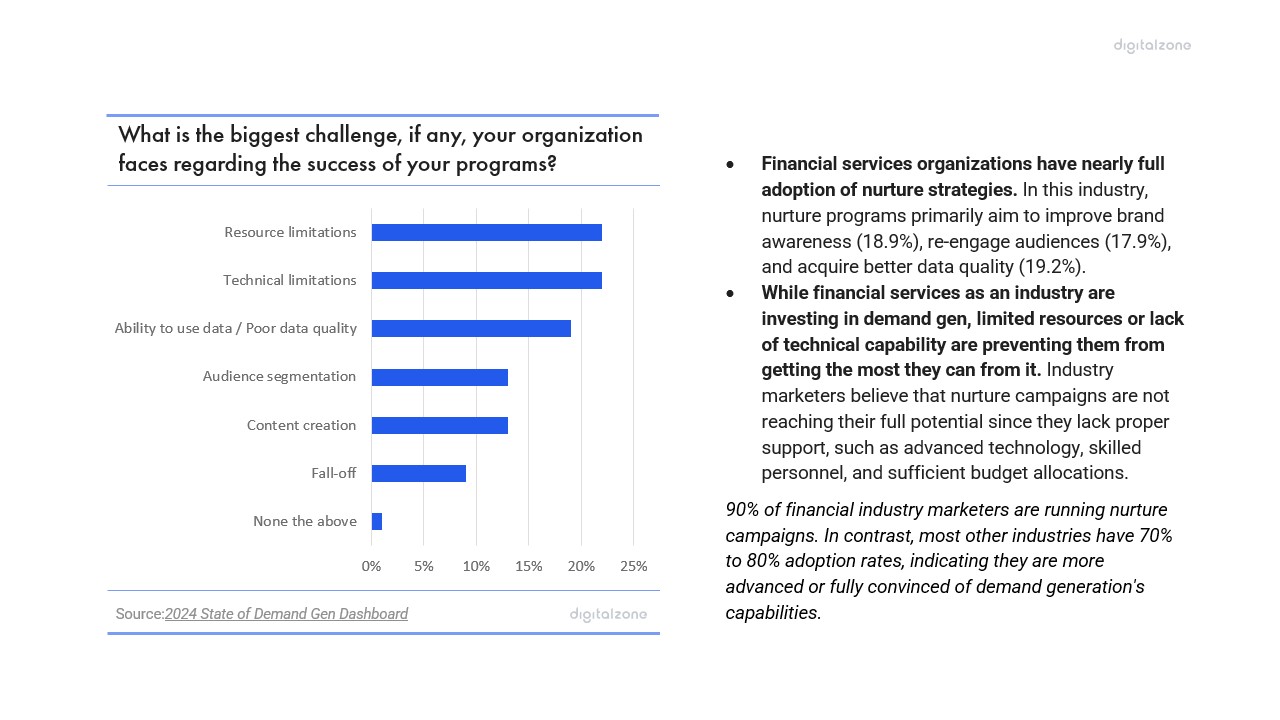

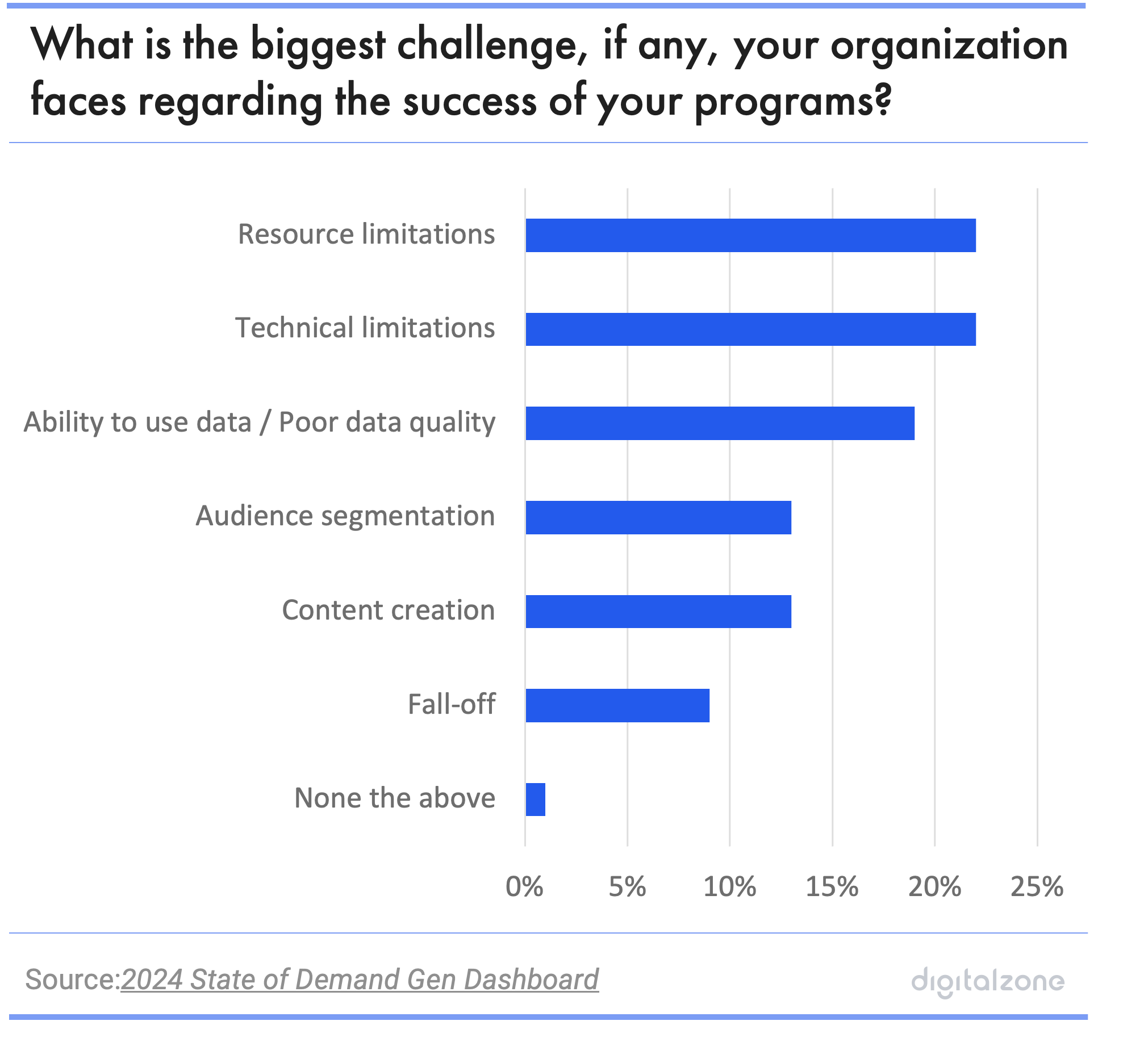

- Financial services organizations have nearly full adoption of nurture strategies. In this industry, nurture programs primarily aim to improve brand awareness (18.9%), re-engage audiences (17.9%), and acquire better data quality (19.2%).

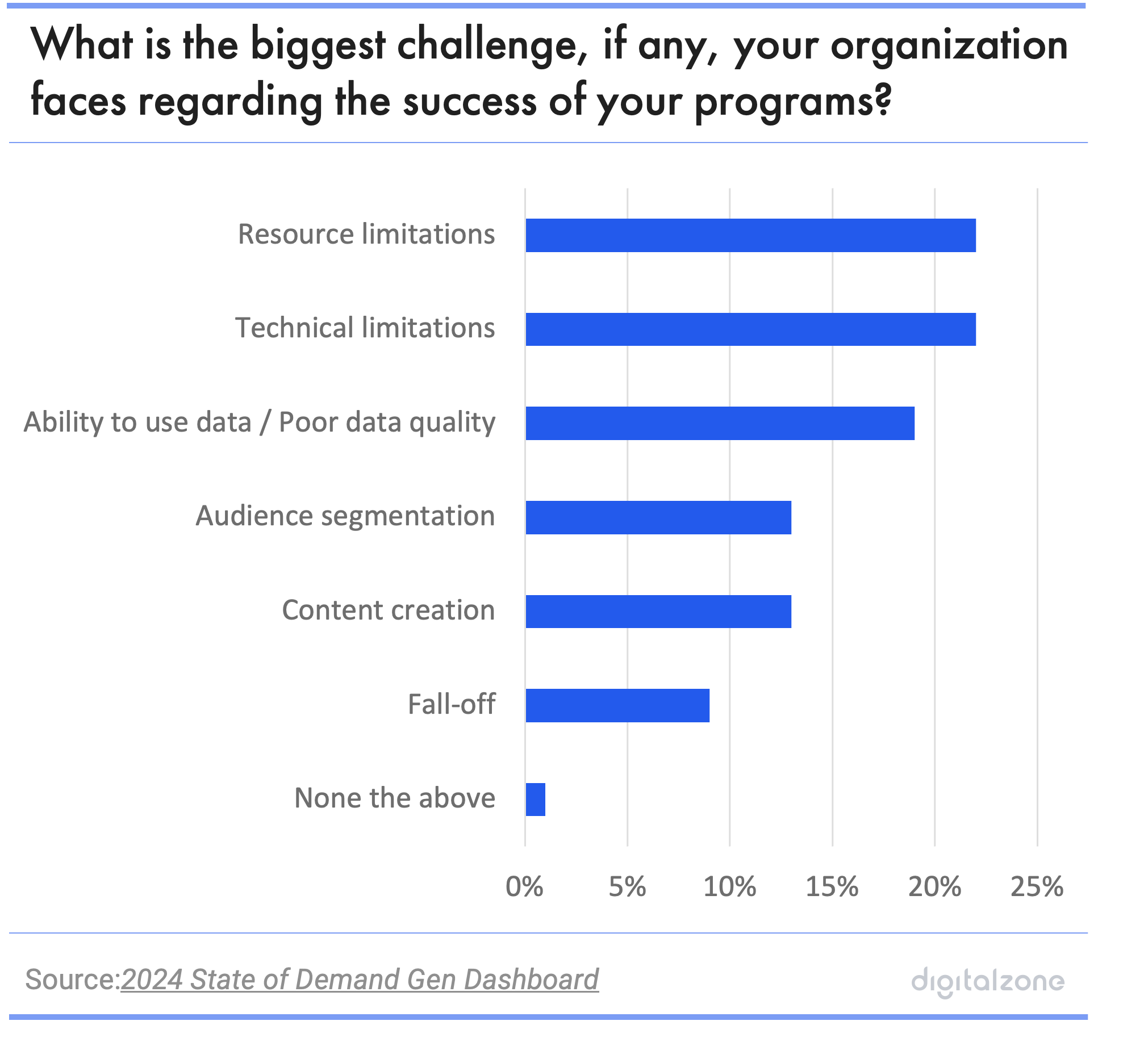

- While financial services as an industry are investing in demand gen, limited resources or lack of technical capability are preventing them from getting the most they can from it. Industry marketers believe that nurture campaigns are not reaching their full potential since they lack proper support, such as advanced technology, skilled personnel, and sufficient budget allocations.

90% of financial industry marketers are running nurture campaigns. In contrast, most other industries have 70% to 80% adoption rates, indicating they are more advanced or fully convinced of demand generation's capabilities.

With the current landscape of increasing interest rates, soaring living costs, and heightened economic uncertainty, and current events like the upcoming election, people are more cautious about entering agreements.

For marketers in financial services companies today, the focus has shifted from the hard sell to building and nurturing relationships. It's essential for marketers to maintain connections with leads and employ creative strategies to cultivate these relationships, moving away from traditional aggressive sales tactics.

This shift not only impacts external marketing efforts but also influences internal strategies, as ROI may take longer to materialize, and the buying journey becomes less linear. Therefore, emphasizing the importance of nurturing is a top priority for marketers in this industry.

Remember, nurturing relationships is crucial as it can significantly impact revenue growth over time. According to Marketo, businesses that excel at lead nurturing generate 50% more sales-ready leads at a 33% lower cost.

Bottom line: Even if a financial services organization is already running nurture campaigns and believes in their effectiveness, they require expanded support to effectively convert leads and spark more discussions in today’s changing market.

Final thoughts

Excelling in financial services marketing hinges on a strategic focus on brand awareness through social media and content marketing, since those mediums are proven to deliver superior ROI. Leveraging advanced analytics and even incorporating AI is becoming essential as data from these efforts starts piling up. And despite 90% of marketers running nurture campaigns, resource constraints often hold them back.

By nailing smarter resource allocation and slicker campaign management that is in touch with today’s consumer needs, financial services industry orgs can turn their data-driven insights into marketing gold.

Sources

2024 financial services industry outlooks – Deloitte

2024 State of Demand Gen Dashboard

5 Digital Marketing Trends in Financial Services – EVERFI

Financial Services – Statista

Global Financial Services Market Overview – ReportLinker

Lead Nurturing Guide – Adobe Experience Cloud Blog

What drives a company’s success? Highlights of survey findings – Strategy&

Executive Summary

Marketers in financial services are increasingly focusing on brand awareness, particularly through social media and content marketing, due to their superior ROI. This trend is clear, with 33% of marketers naming social media as their primary content syndication channel and 28% favoring content marketing. Both strategies play crucial roles in nurturing programs aimed at enhancing brand awareness and improving data quality. Additionally, with 23% of financial services marketers expanding the number of channels to optimize ROI, it's evident that brand awareness remains a top focus.

As brand awareness campaigns proliferate, the volume of data collected is ballooning, necessitating a strategic overhaul in data optimization. The financial services sector exemplifies this need, as businesses increasingly rely on advanced data analytics to stay competitive. With a notable 82% of financial services marketers leveraging automation for data analysis and 85% using sophisticated tools to create personalized content for their target audiences, industry leaders must address the ongoing skills gap or embrace the capabilities of artificial intelligence (AI) to fully capitalize on these opportunities.

Despite an impressive 90% adoption rate of nurture programs within the financial services sector, limited resources are preventing these initiatives from reaching their full potential. The industry faces significant resource constraints that impede the development and execution of more robust nurture campaigns. To overcome these challenges and fully capitalize on nurture strategies, there is a pressing need for better resource allocation and enhanced efficiency in campaign management.