Understanding What Drives B2B Telecom Buyers Research reveals that telecom buyers prefer a prompt purchasing process and rely on straightforward information to guide their decisions.

Posted: Jan 8, 2025

The telecommunications industry is experiencing significant shifts, driven by rapid technological advancements and evolving consumer expectations. With 5G networks rolling out around the globe, we’re seeing faster data speeds, lower lag times, and massive IoT growth. These changes are transforming everything from smart cities to self-driving cars.

At the same time, cloud computing, edge computing, and AI-driven tech are making it possible for telecom companies to improve their networks and deliver better customer experiences.

As the demand for fast, reliable connectivity rises—partly because of remote work and the growing digitalization of industries—putting telecom providers under more pressure than ever to stand out.

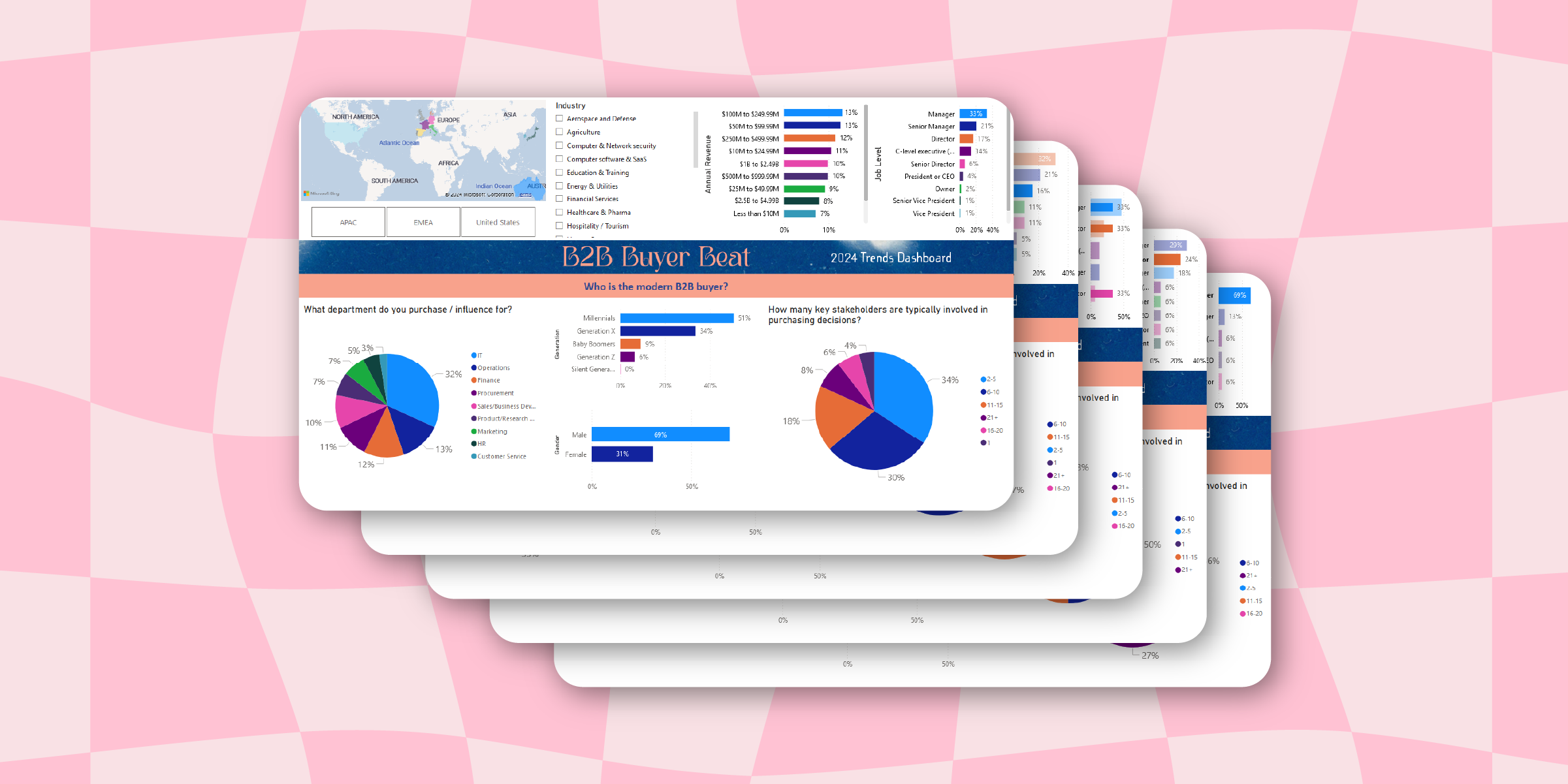

Understanding what drives B2B buyers in the telecom market is key to staying ahead in a competitive industry. This blog post dives into key insights about these buyers, using data from The 2024 B2B Buyer Beat Dashboard—an extensive resource that gathers input from 1,500 decision-makers worldwide. These findings, highlighted in the B2B Buyer Beat Insights and Trends Report, offer a comprehensive look at the major developments and underlying factors shaping buyer behavior today.

We asked: What insights can we gather about buyers purchasing telecommunications products?

Executive Summary

- Telecom buyers form opinions fast, with over half needing only a few interactions to evaluate and seriously consider a vendor since they are informed purchasers. Their top priority is ease of doing business, emphasizing that their need for straightforward solutions and clear alignment with their expectations. Technical capabilities also remain a crucial factor, reflecting their results-oriented approach to decision-making. When it comes to content that influences their decision-making, supplier websites and online reviews are the most trusted resources, showcasing buyers’ preference for self-service information over emotionally driven or overly sentimental marketing efforts.

- Small businesses are a vital part of the telecom market, making up 29% of buyers from companies earning under $25 million annually. These decision-makers often come with clear demographic patterns—Millennials (41%) and Generation X (38%) dominate the field, many in managerial or senior roles. Additionally, these purchasers are mostly male. When engaging buyers from small businesses, telecom providers can confidently move away from generic marketing strategy and focus instead on understanding their distinct buyer profiles.

- Telecom purchase decisions are typically made at a brisk pace, with 48% of buyers completing the process within 1 to 3 months, often relying on small teams of 2 to 5 stakeholders. However, delays can arise due to competitive assessments and market shifts, and overall buying timelines have slightly increased over the past two years. The pandemic has further influenced the market, prompting many buyers to explore cloud providers. This shift has added complexity to the decision-making process and the strategies providers use to go to market.

1. Opinions are formed fast

More than half (54%) of telecommunications buyers need only a few brand interactions before seriously considering a vendor. This shows that telecom buyers are quick at discerning if a brand is aligned with their needs or not.

- When the time comes to choosing between telecom providers, ease of doing business is what buyers care about most and that reflects their straightforward nature. Capabilities are the top priority for telecom buyers, as they value straightforward solutions and know exactly what they need. While diversity, equity, and inclusion have importance in broader contexts, they hold less sway in these more technical, results-focused decisions.

- Supplier websites (11.5%) are the most helpful asset when a telecom buyer is determining their final purchase decision, according to survey participants, while online reviews (8.6%) take the second top spot. Assets like podcasts, tip sheets or long form video rarely factor into a decision, as less than 3% of telecom buyers use them in the decision-making process.

Telecommunication buyers demand reliability and performance and can easily discern through surface-level claims to judge a brand's true credibility.

This highlights telecom buyers' ability to form opinions in a short amount of time and with minimal external influence, which makes first impressions critical. Buyers often rely on established standards and trust signals—like technical prowess and clear communication—to make informed decisions based on limited interactions.

A significant driver for these telecom buyers is the demand for providers with robust cybersecurity capabilities. According to McKinsey, enterprises across the globe overwhelmingly cite cybersecurity, along with privacy, as their top technology and telecommunications need. This concern is a primary reason for changing providers across various product categories.

Buyers are showing more interest in bundled services, which combine multiple telecom solutions into one package. This leaves businesses with a key choice: go with the best individual products across different categories or choose a convenient, all-in-one option that simplifies everything.

Increasingly, companies are favoring the ease and simplicity of bundled services from a single provider over sourcing the highest-quality products from multiple vendors.

Moreover, research from Deloitte indicates that adding each additional service to a bundle enhances customer satisfaction, further reinforcing the trend toward integrated offerings.

Bottom line: Telecom buyers prioritize vendors with strong cybersecurity capabilities that demonstrate credibility in today’s market. They also prefer bundled services and value providers that enhance operational efficiency.

2. Buyers hail from small companies

A major chunk of telecom buyers come from organizations that are small and nimble, with 42% of telecom buyers working for orgs with less than $25 million in annual revenue.

- Of telecom buyers, 41% are Millennials (people born between 1981 and 1996), while 38% belong to Generation X (people born between 1965 and 1980). A significant portion of these buyers (36%) hold managerial roles, and 24% are senior managers. This distribution is expected, as both generations are at an age where they have advanced in their careers and are likely to make key purchasing decisions in their organizations.

- A vast majority of telecom buyers (67%) are male, highlighting the male-dominated nature of the industry. This gender imbalance may reflect broader trends within the technology and telecommunications sectors where historically, men have held more positions.

We know who telecom buyers are—they’re decision-makers from smaller companies with clear demographic profiles tied to their age and gender. There’s no need for a one-size-fits-all marketing approach; telecom providers can confidently shape their strategies to connect with and support these specific buyer preferences.

The survey data indicates that a substantial portion of the telecom market consists of smaller businesses. This suggests a strong demand for telecom solutions such as internet and phone tailored to the unique needs of smaller organizations, including scalability, affordability, and flexibility.

In fact, McKinsey & Company discovered that small businesses allocate more funds to telecom services compared to the large enterprise accounts that providers have traditionally targeted.

It’s an exciting time for small businesses, too. A report from Verizon shows that 59% of small business owners anticipate growth in the next year. If telecom providers can establish relationships with these organizations early on, there is significant potential for these businesses to become loyal customers as they expand.

Bottom line: Small businesses are a driving force behind the telecom market's growth, fueled by B2B buyers with a clear need for customized, scalable solutions. Small businesses are shaping the way the telecom industry grows, and that’s exactly why providers need to zero in on this key part of the market.

3. Vendor selection is a short cycle

With 48% of telecom buyers reporting that their vendor selection process typically takes one to three months, it’s clear that—for now—quick decision-making is the norm.

- Typically, only a few key stakeholders are involved in purchasing decisions. A significant 41% of respondents said just two to five individuals are part of determining a vendor, which also highlights the intimacy and autonomy that most telecom buyers and buying committees have within their organizations.

- The telecom buying process is typically quick, but delays can occur due to the nature of the telecommunications market. Competitive assessment, cited by 18% of buyers, is the most common factor for delays, often due to the need to compare providers thoroughly. Additionally, 17% of buyers point to major market shifts, which reflect the fast-paced nature of the industry.

- Telecom product or service purchasers report little progress in improving their buying timelines over the past two years. According to the survey, 41% of respondents said their timeline has stayed the same, while 35% noted it has increased somewhat. This suggests that buying efficiency isn't improving and may, in fact, be getting worse.

Telecom buyers act fast with small teams, but competitive pressures and market changes can cause delays that keep buying timelines steady or even growing slightly longer.

The lengthening buying process is partly because of the shifting nature of the industry. Deloitte reported that since the pandemic, many purchasers of connectivity services have increasingly turned to cloud providers. This has further complicated decision-making as telecoms assess new solutions and competitors.

Consumers in the U.S. now have more choices than ever for internet service, thanks to increased government funding that is bringing broadband to areas that were previously underserved.

For context, as of June 2021, the Federal Communications Commission reported that nearly 61% of households had access to three or more wireline providers.

Satellite internet now covers the entire U.S., and Fixed Wireless Access (FWA) is increasingly available to consumers.

For telecom providers, this growing variety of connectivity solutions, the influx of new competitors, and larger government mandates create potential uncertainty. Providers must navigate these factors while ensuring they meet consumer demands for reliable, high-speed internet in an increasingly competitive market.

This complexity may extend to decision-making timelines as telecom providers are constantly re-evaluating their position in a shifting industry.

Bottom line: While telecom buyers typically make quick decisions with small teams, increasing competition, shifting industry trends, and new connectivity solutions are complicating the process and extending buying timelines.

Final thoughts

The telecommunications industry is evolving fast, and B2B buyers are changing right along with it. That means vendors have to stay agile to keep up.

According to insights learned from The 2024 B2B Buyer Beat Dashboard, telecom buyers are sharp and know exactly what they want. They make quick decisions, often within three months, and care a lot about how easy a vendor is to work with and whether their cybersecurity measures are rock-solid.

Small businesses are a big part of the market too. They’re looking for services that can grow with them—scalable, bundled solutions from a single provider are especially popular. While decision timelines are usually short, delays can happen if buyers need to assess the competition or adapt to market changes.

To succeed in this space, vendors need to offer credible and relevant solutions that meet these shifting demands.

Sources

Tech talent in transition: Seven technology trends reshaping telcos - McKinsey & Company

Global Edge Computing Market - Grand View Research

State of AI in Telecommunications: 2024 Trends - NVIDIA

Executive Summary

- Telecom buyers form opinions fast, with over half needing only a few interactions to evaluate and seriously consider a vendor since they are informed purchasers. Their top priority is ease of doing business, emphasizing that their need for straightforward solutions and clear alignment with their expectations. Technical capabilities also remain a crucial factor, reflecting their results-oriented approach to decision-making. When it comes to content that influences their decision-making, supplier websites and online reviews are the most trusted resources, showcasing buyers’ preference for self-service information over emotionally driven or overly sentimental marketing efforts.

- Small businesses are a vital part of the telecom market, making up 29% of buyers from companies earning under $25 million annually. These decision-makers often come with clear demographic patterns—Millennials (41%) and Generation X (38%) dominate the field, many in managerial or senior roles. Additionally, these purchasers are mostly male. When engaging buyers from small businesses, telecom providers can confidently move away from generic marketing strategy and focus instead on understanding their distinct buyer profiles.

- Telecom purchase decisions are typically made at a brisk pace, with 48% of buyers completing the process within 1 to 3 months, often relying on small teams of 2 to 5 stakeholders. However, delays can arise due to competitive assessments and market shifts, and overall buying timelines have slightly increased over the past two years. The pandemic has further influenced the market, prompting many buyers to explore cloud providers. This shift has added complexity to the decision-making process and the strategies providers use to go to market.