Unpacking the SaaS Purchasing Process of B2B Buyers Data shows that SaaS buyers want to feel empowered to make swift purchase decisions that their team can rally behind.

Posted: Nov 7, 2024

The world of SaaS (Software as a Service) is synonymous with innovation because it has completely transformed how we access software through the cloud. This model enables you to use powerful applications anytime, anywhere, without the need for installation or maintenance on your own device, offering convenience and flexibility.

SaaS products ensure you’re equipped with the tools you need, ready when you are, thanks to the seamless integration of cloud technology.

The SaaS landscape is primarily categorized into two models: vertical and horizontal. Vertical SaaS provides tailored solutions for specific industries, addressing niche market needs, while horizontal SaaS, such as Slack and Zoom, serves a wide variety of industries.

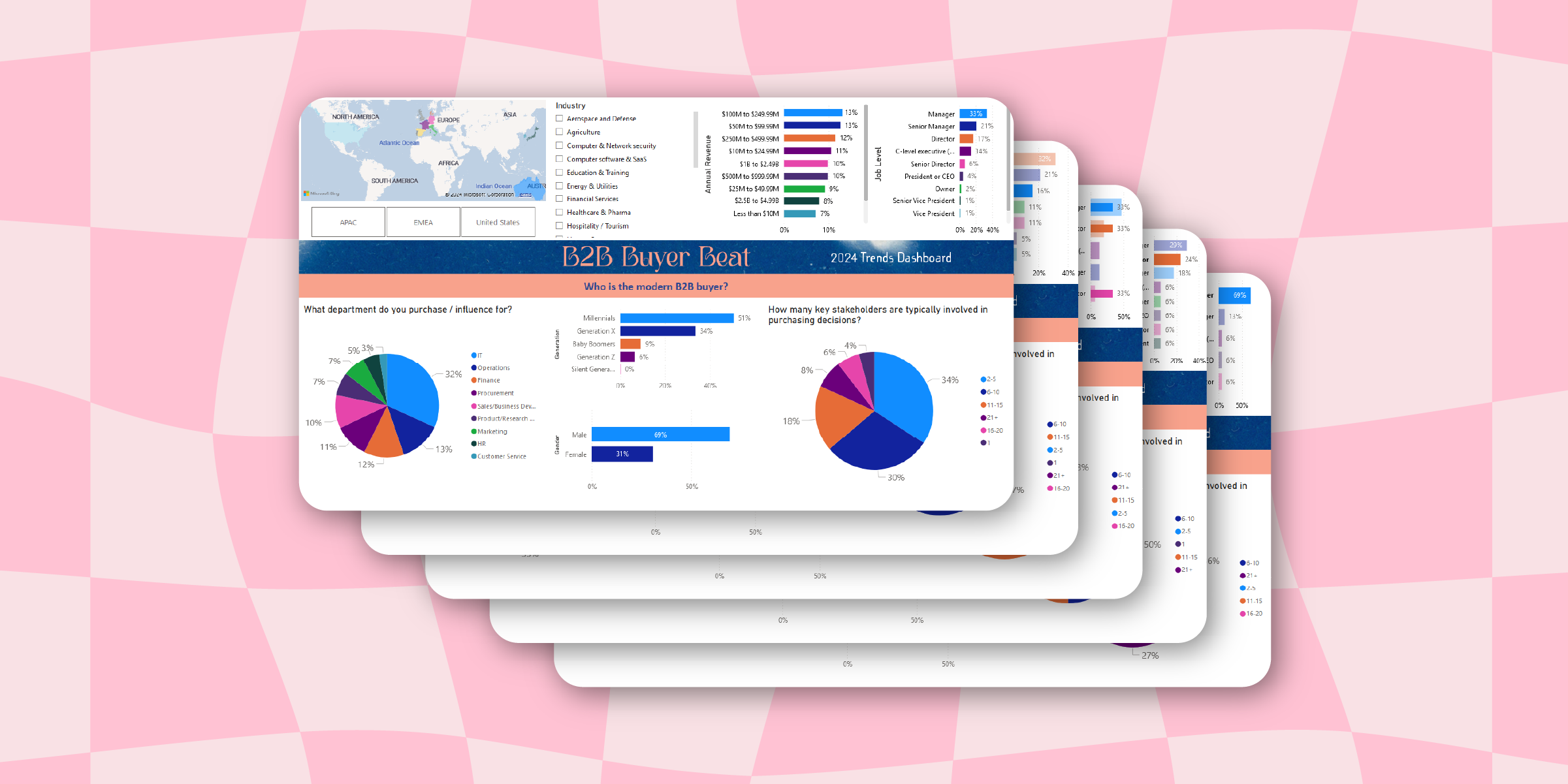

In this report, we delve into SaaS buyer-specific insights revealed in The 2024 B2B Buyer Beat Dashboard, which gathers data from 1,500 B2B decision-makers globally highlighted in the B2B Buyer Beat Insights and Trends report. We'll take a look at the exciting trends and main factors currently influencing SaaS buyers.

We asked: What insights can we gather about buyers purchasing SaaS products?

Executive Summary

- In the world of SaaS purchasing, making decisions is truly a team effort. It's all about teamwork now, with 64% of SaaS buyers involving six to ten key stakeholders in their decision-making process. This highlights the essential role of collaboration and agreement when selecting vendors. Clearly, aligning multiple perspectives is crucial for making swift and effective purchases. For vendors, understanding these dynamics is key to streamlining the buying journey and addressing the varied needs of organizational buyers.

- In the world of SaaS purchasing, making decisions is truly a team effort. It's all about teamwork now, with 64% of SaaS buyers involving six to ten key stakeholders in their decision-making process. This highlights the essential role of collaboration and agreement when selecting vendors. Clearly, aligning multiple perspectives is crucial for making swift and effective purchases. For vendors, understanding these dynamics is key to streamlining the buying journey and addressing the varied needs of organizational buyers.

- A discerning 37% of SaaS buyers deem a brand reputable after just three to five encounters. In a domain known for trendiness and shaking up norms, it’s noteworthy that many potential SaaS buyers aren't dazzled by flashy marketing and constant brand interactions. What they really want is to find products that solve their needs. It's all about delivering quality over quantity, proving that a well-aimed message can be more compelling than a barrage of noise when it comes to capturing their interest.

SaaS Marketing Trends & Industry Pathways

- The SaaS market is projected to reach $908.21 billion by 2030, with a compound annual growth rate (CAGR) of 18.7%.

- SaaS is advancing by integrating AI and machine learning to enhance efficiency and personalization. The pandemic accelerated the adoption of cloud solutions, with remote work and virtual meetings becoming standard practice. These developments emphasize the necessity for adaptable, scalable tools that facilitate seamless remote collaboration and communication for individual needs.

- The global customer success platform market is projected to reach $31 billion by 2026. Over 72% of businesses prioritize customer success, which is crucial for customer retention and revenue growth. The global customer success platform market of SaaS is projected to reach $31 billion by 2026.

1. Agreement Moves the Needle in SaaS Purchases

In today's SaaS landscape, decision-making is a collective effort. 64% of buyers indicate that there are numerous stakeholders—at least six or more—in the decision-making process.

- Unexpected purchase delays for SaaS buyers are often the result of internal stakeholders, whose involvement can decisively slow down the process. Factors such as difficulty in building consensus, changes in key decision-makers, and shifts in leadership collectively account for 35% of delays. These internal dynamics highlight how stakeholders can significantly influence the purchasing timeline.

- SaaS buyers come from companies with either a large group of stakeholders or just a few. Most buyers are engaging either a large group of 6 to 10 stakeholders or keep it streamlined with just 2 to 5 stakeholders to make a purchase decision. This variation is linked to the fact that more than half of SaaS buyers hail from companies with annual revenues between $10 and $999 million. This wide revenue range indicates that a company's wealth plays a crucial role in determining the number of stakeholders involved and, subsequently, the buying timeline.

- The majority of SaaS buyers occupy middle management positions and depend on others to make the final purchasing decision. Survey results reveal that over half of these buyers are either managers (33%) or senior managers (19%), lacking the authority to proceed with purchases without input from more senior stakeholders.

SaaS buyers exhibit a dual nature: they might operate like a nimble startup, moving quickly within small teams, or function more like a large enterprise, engaging with multiple stakeholders across various departments in any decision.

Understanding whether you're dealing with a small, agile team or a large, layered enterprise can significantly enhance your approach, ensuring that your messaging resonates effectively and meets the diverse needs of these buyers.

With many B2B organizations, understanding the maturity of the company can indicate the size or nature of the buyer’s stakeholder dynamic since older organizations are more likely to have a larger staff. For younger companies, the source of funding of your buyer’s organization is crucial for grasping the dynamics of stakeholder involvement. Bootstrapped companies often feature fewer stakeholders, led by a close-knit team, while VC-backed firms involve a wider array of stakeholders across various departments.

Additionally, grasping the distinct growth patterns between bootstrapped and VC-backed companies is vital for vendors aiming to craft effective marketing strategies. VC-backed companies are often associated with rapid, high-growth trajectories, leveraging their funding to operate at a loss and fuel expansion.

On the other hand, bootstrapped companies typically experience more linear and consistent growth, with the top quartile reaching $1M ARR (annual recurring revenue) in just two years—only slightly slower than their VC-backed counterparts by four months. These companies focus on profitability and adaptability, emphasizing sustainable growth. By aligning communication narratives with these funding dynamics, vendors can position their products or solutions to resonate with buyers that prioritize either rapid expansion or sustainable growth.

Bottom line: For marketers targeting SaaS buyers, it's crucial to grasp the growth stage and trajectory of the company to craft messages that resonate effectively—regardless of how many stakeholders are involved.

2. Speed Takes Center Stage in Decision Making

Quick decision-making is crucial for SaaS buyers, making it essential for vendors to prioritize efficiency.

- The majority of SaaS buyers make swift decisions when selecting a vendor. According to the survey, 47% of purchasers finalize their vendor choice in just 1-3 months. Following that, 33% take 4-6 months to decide. This data underscores that most buying decisions are made within half a year, reflecting the brisk pace of buyers.

- The SaaS industry has remained efficient in its vendor selection timeline. Despite many buyers in other B2B industries saying that it's taking longer to select a vendor, a significant 34% of SaaS buyers say that the average amount of time it takes to make a purchasing decision has remained the same over the last two years.

SaaS buyers place a strong emphasis on efficiency, maintaining high standards even as other B2B industries slow their buying processes. This fast-paced culture means that if vendors don't meet their expectations, these buyers are quick to move on to other options.

According to an article by Vena Solutions that detailed the 2024 trends and benchmarks, a significant 52% of SaaS buyers are directing their investments towards new technology aimed at enhancing productivity. This trend indicates a strong dedication among SaaS buyers to maintain and improve efficiency within their operations. By adopting cutting-edge technologies, these buyers are positioning themselves to meet the increasing demands of a competitive market.

Furthermore, the article highlighted that nearly 90% of IT professionals stress the critical role of automation in effectively managing SaaS operations. Automation is seen as a pivotal element in streamlining processes and reducing manual workload, thereby increasing efficiency. However, a substantial 64% of IT professionals report facing challenges due to insufficient resources to fully implement automation strategies.

These findings underscore the urgent need for vendors to deliver a buying process that meets the efficiency-driven goals of their prospects.

Bottom line: As buyer companies grow exponentially and include more stakeholders, their steadfast commitment to swift decision-making endures—requiring marketers to align their efforts to their fast-paced style.

- 75% of B2B marketers say their organization enlisted more than 1 vendor to support demand gen.

- 82% of Marketers in IT services leveraging AI to automate data analysis for their marketing strategy.

- 85% of Marketers in IT services using both data and AI to create personalized content for their target audiences.

3. Quality Over Quantity in SaaS Brand Perception

Amidst a sea of innovative startups and changing standards, these consumers value genuine interactions over flashy advertisements. Their behaviors indicate that a well-crafted message can capture their attention more effectively than sheer volume.

- 47% of SaaS buyers quickly recognize a major player after just five or fewer brand exposures, showcasing their open-mindedness and ability to form opinions with minimal influence. A notable 7% of SaaS purchasers will even trust a brand's reputation after just one or two interactions, showing that they can make a judgement with minimal content.

- Technologically savvy SaaS buyers jump straight to the digital details when determining their feelings about a brand. For them, a vendor's website (10.4%) and online reviews (9.2%) stand out as the most valuable content assets in the decision-making process, as it showcases the brand's digital fluency and adeptness in leveraging technology for communication.

- With exactly half of SaaS purchasers being Millennials, these digital natives are constantly connected to their devices—offering increased opportunities for engaging with digital touchpoints in shorter time frames. This connectivity requires less interactions since they are often interacting with media.

SaaS buyers are confident decision-makers, so leveraging their trained intuition in digital best practices to quickly assess a vendor's trustworthiness. This expertise enables them to make informed judgments with fewer interactions than their less technologically savvy counterparts in other industries.

According to Gartner, buyers dedicate about 27% of their time to conducting online research during the buying process and they estimate that 80% of all B2B sales interactions to be digital by 2025. This streamlined approach reveals the industry's reliance on digital insights to guide purchasing decisions. Their ease in navigating digital landscapes not only accelerates the decision-making process but also ensures that they are aligning with vendors who meet their high standards of trust and reliability.

As noted in the Fortune Business Insights report, the global SaaS market is projected to reach USD 908.21 billion by 2030. This growth stresses the critical importance of maintaining a top-notch user experience (UX) on branded websites and digital assets. Vendors must recognize and adapt to these expectations by providing clear and accessible information to meet the discerning needs of these buyers.

Bottom line: Amidst a sea of innovative startups and evolving standards, consumers prioritize intentional digital interactions over flashy advertisements. This demonstrates that well-crafted, easily accessible messages capture the attention of this discerning audience more effectively than sheer volume.

Final thoughts

Success in the SaaS industry hinges on understanding its exponential growth and the distinct expectations of buyers. As the sector races towards an impressive $908.21 billion by 2030, grasping the shifting market dynamics and the unique demand of its forward-thinking clientele becomes crucial.

The insights from the 2024 B2B Buyer Beat Dashboard reveal that collaborative decision-making and agility in vendor selection are key to maintaining a competitive edge. In today's fast-paced world, blending varied perspectives and making snap decisions are key, emphasizing the value of collaboration and nimbleness.

Moreover, the emphasis on quality over quantity in brand perception shows the need for meaningful engagements that cut through the noise. By aligning strategies to these trends, SaaS companies can transform these buyer insights into powerful growth opportunities.

Sources

Rising Above The Competition In The Complex SaaS Ecosystem — Forbes

How AI is Revolutionizing the SaaS Industry — SaaS Academy

72% Of Businesses Name Improving Customer Experience Their Top Priority - Forrester

Global Customer Success Platforms Market Report - Businesswire

Executive Summary

- In the world of SaaS purchasing, making decisions is truly a team effort. It's all about teamwork now, with 64% of SaaS buyers involving six to ten key stakeholders in their decision-making process. This highlights the essential role of collaboration and agreement when selecting vendors. Clearly, aligning multiple perspectives is crucial for making swift and effective purchases. For vendors, understanding these dynamics is key to streamlining the buying journey and addressing the varied needs of organizational buyers.

- Swift decision-making is essential, and there is a shared focus on time efficiency among organizations and their vendor partners. As SaaS technology continually advances, quick, decisive actions are required to remain relevant. Most buying decisions are made within six months, with 47% of buyers report that the vendor selection process takes only 1-3 months and 33% indicating that it takes 4-6 months to make a decision. In a landscape where speed offers a competitive edge, partnering with organizations that prioritize agility is crucial to staying ahead in the competitive race.

- A discerning 37% of SaaS buyers deem a brand reputable after just three to five encounters. In a domain known for trendiness and shaking up norms, it’s noteworthy that many potential SaaS buyers aren't dazzled by flashy marketing and constant brand interactions. What they really want is to find products that solve their needs. It's all about delivering quality over quantity, proving that a well-aimed message can be more compelling than a barrage of noise when it comes to capturing their interest.