How to Optimize Cloud Purchasing for the Modern B2B Buyer Research shows that today’s buyers prioritize efficiency and are looking for direct brand interactions with cloud solution providers to speed it up.

Posted: Dec 4, 2024

Cloud computing has become an important pillar of business for companies across industries as our world becomes more digitally dependent. The technology enables scalable and cost-effective solutions for managing and deploying data, SaaS applications, and other business functions.

As B2B organizations continue to transition to the cloud, decision-makers such as CTOs, CIOs, and IT managers are crucial in crafting purchasing strategies. They focus on identifying cloud solutions that meet specific needs, looking at cost, scalability, integration capabilities, and vendor reliability.

Their choices are important because they not only impact technology infrastructure but also drive broader business outcomes, like productivity and competitiveness.

In this blog post, we dive into insights specific to cloud product buyers revealed in The 2024 B2B Buyer Beat Dashboard, which gathers data from 1,500 B2B decision-makers globally highlighted in the B2B Buyer Beat Insights and Trends report. We're here to spotlight the major takeaways and key factors shaping how these buyers behave.

We asked: What insights can we gather about buyers purchasing cloud products?

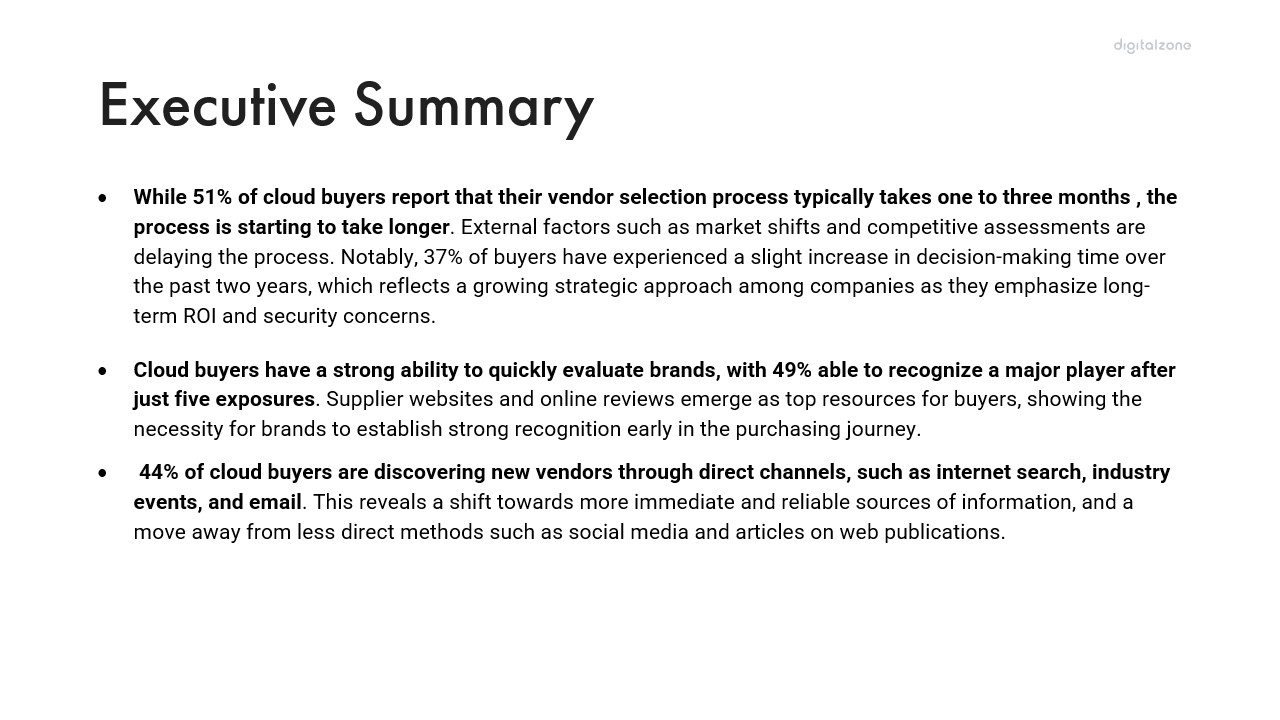

Executive Summary

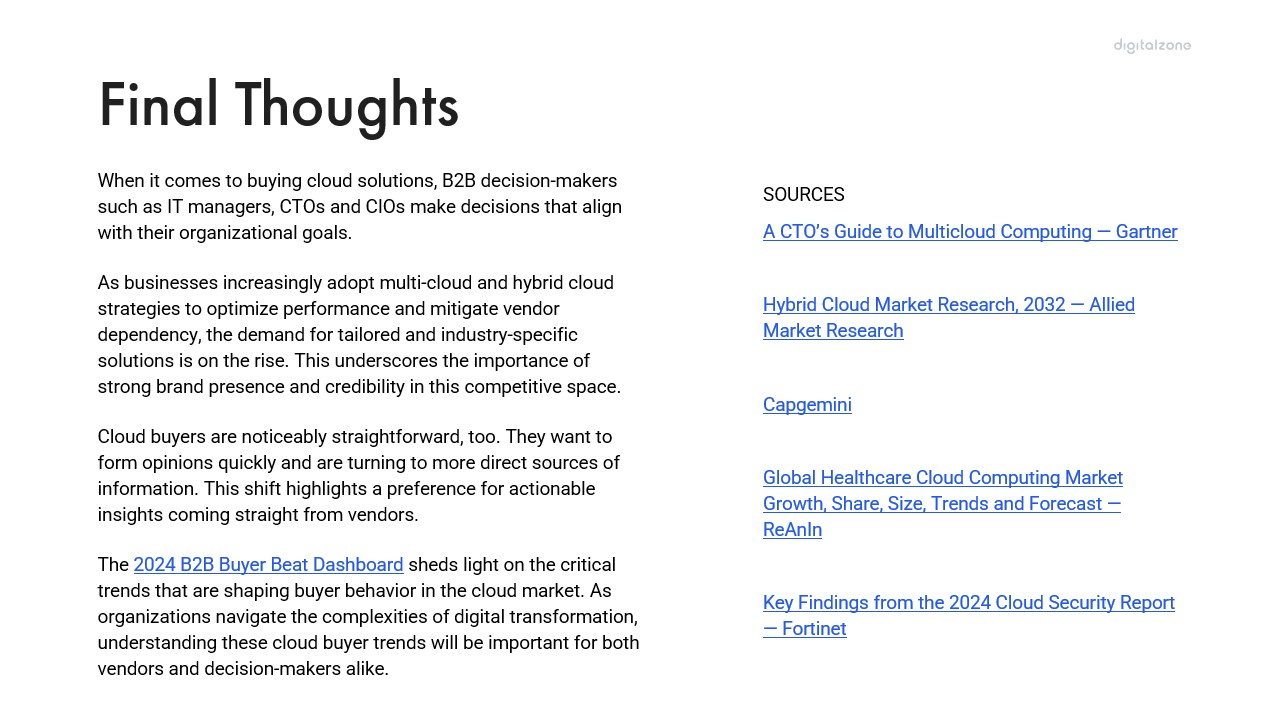

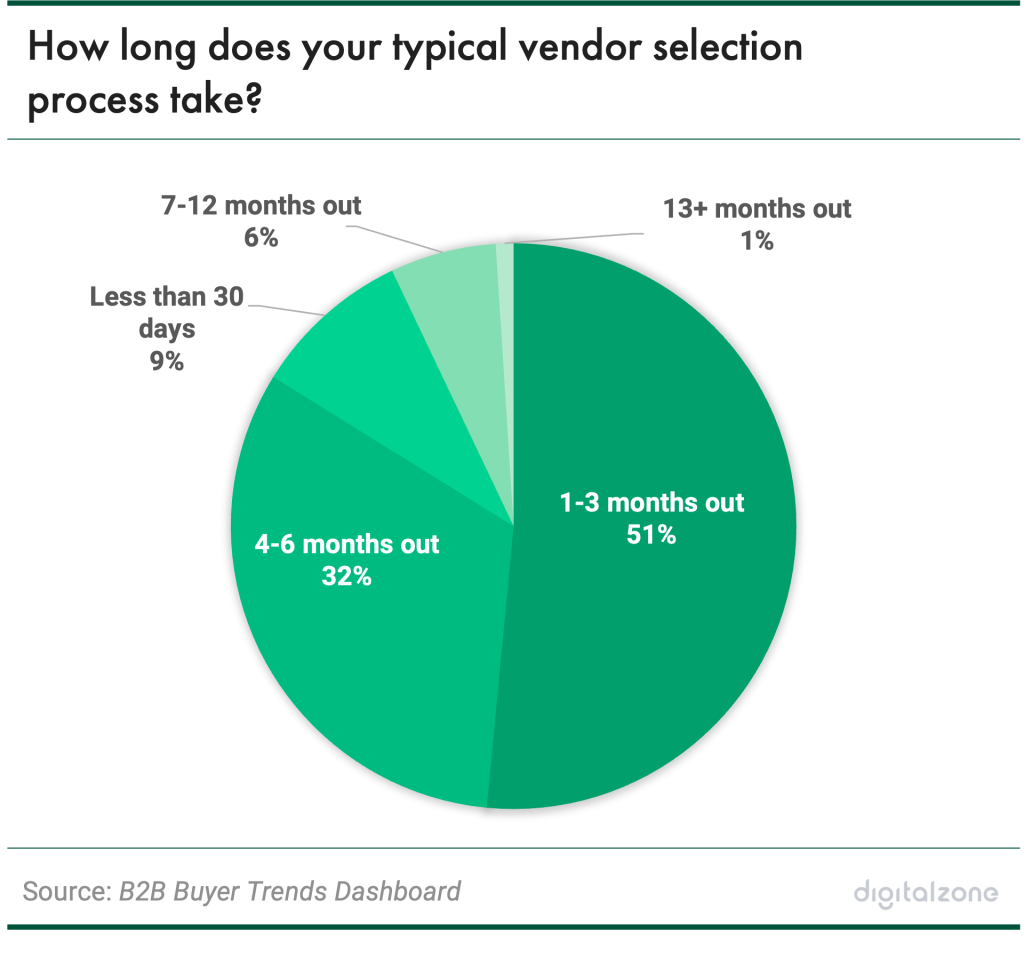

- While 51% of cloud buyers report that their vendor selection process typically takes one to three months, the process is starting to take longer. External factors such as market shifts and competitive assessments are delaying the process. Notably, 37% of buyers have experienced a slight increase in decision-making time over the past two years, which reflects a growing strategic approach among companies as they emphasize long-term ROI and security concerns.

- Cloud buyers have a strong ability to quickly evaluate brands, with 49% able to recognize a major player after just five exposures. Supplier websites and online reviews emerge as top resources for buyers, showing the necessity for brands to establish strong recognition early in the purchasing journey.

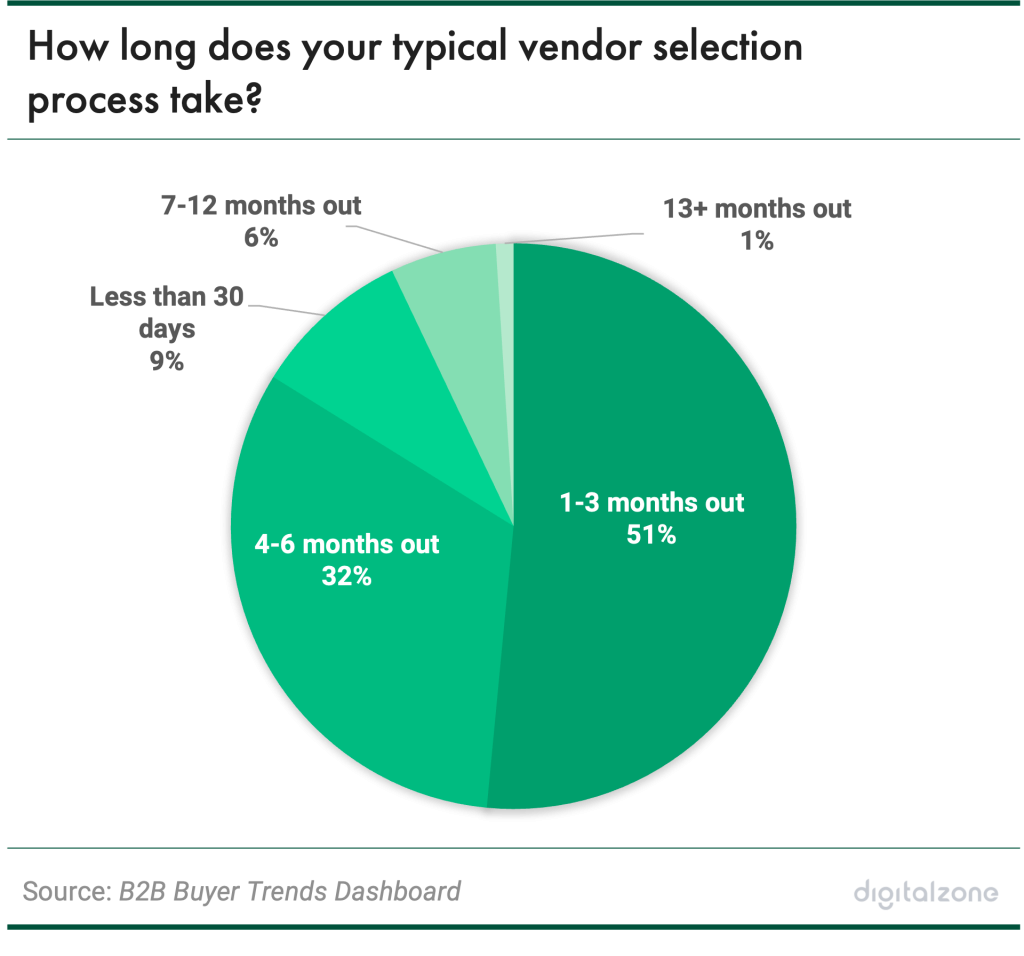

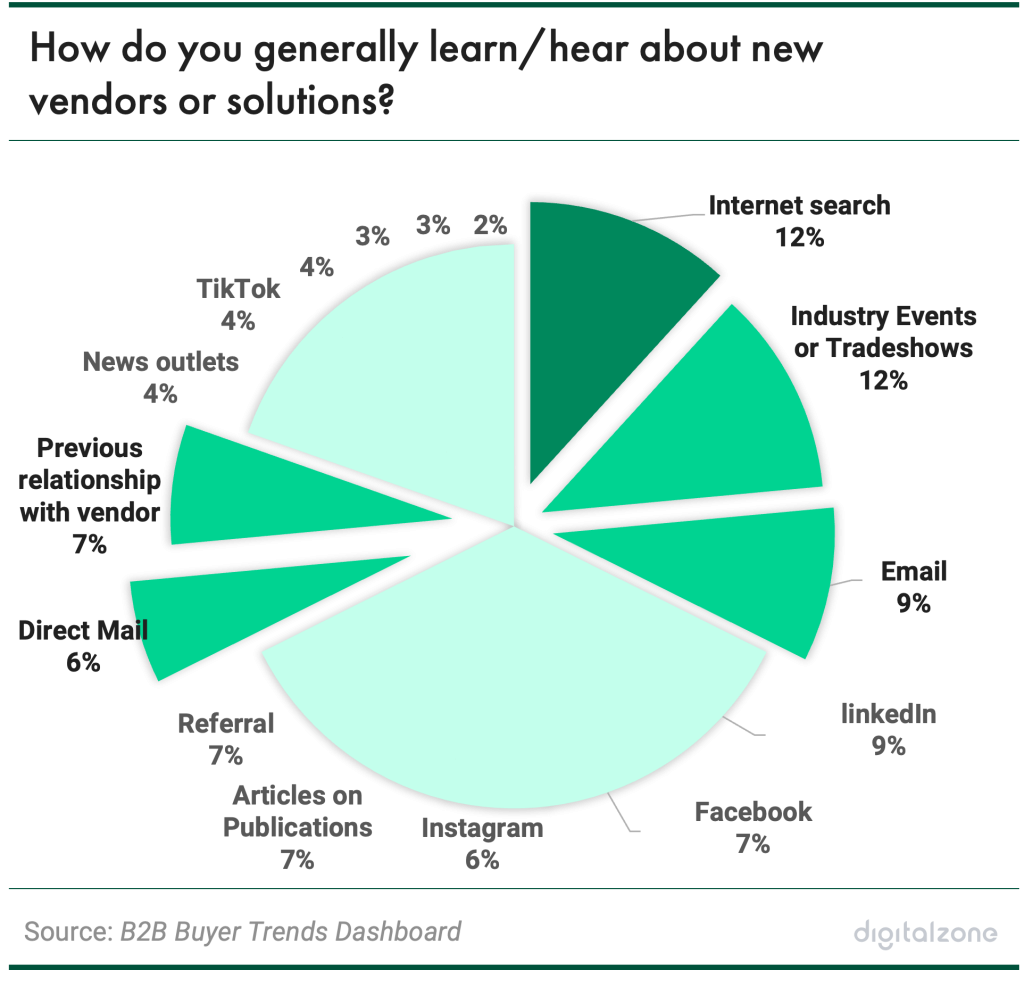

- 44% of cloud buyers are discovering new vendors through direct channels, such as internet search, industry events, and email. This reveals a shift towards more immediate and reliable sources of information, and a move away from less direct methods such as social media and articles on web publications.

Cloud Product Marketing Trends & Industry Pathways

- Businesses are increasingly adopting multi-cloud and hybrid cloud strategies. A multi-cloud approach allows them to use multiple cloud providers to optimize costs and performance while reducing dependency on a vendor. By 2026, over 90% of enterprises are expected to have some form of multi-cloud strategy. Hybrid cloud adoption is growing as well, driven by the flexibility of managing workloads across private and public clouds. The hybrid cloud market is projected to reach $414.1 billion by 2032, growing at a CAGR of 17.2%.

- Cloud providers are focusing on industry-specific solutions tailored to sectors like healthcare, finance and retail. For instance, in the financial sector, 89% of executives feel a cloud-enabled platform is important for delivering the agility and innovation needed to meet their growing business demands. Cloud solutions in healthcare are also growing due to the need for enhanced data security and compliance with privacy regulations like HIPAA. This contributes to projected annual growth rates of 15.9% in the healthcare cloud sector.

- With the rise in cyber threats and tighter regulations, businesses are prioritizing cloud security as a major factor in purchasing decisions. One report found that 96% of businesses are moderately or extremely concerned about cloud security. Likewise, companies that fail to meet data compliance standards risk costly penalties. As a result, cloud providers offering robust security features, such as encryption and compliance with GDPR, are seeing increased demand.

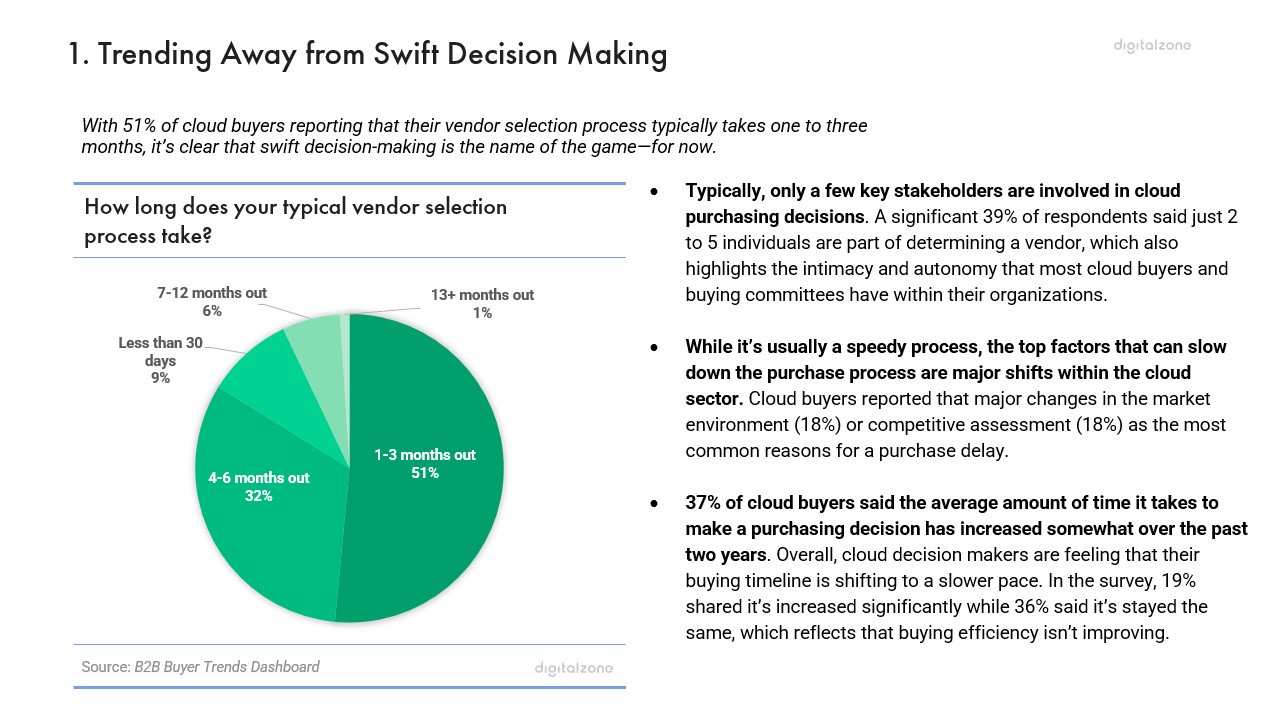

1. Trending Away from Swift Decision Making

With 51% of cloud buyers reporting that their vendor selection process typically takes one to three months, it’s clear that swift decision-making is the name of the game—for now.

- Typically, only a few key stakeholders are involved in cloud purchasing decisions. A significant 39% of respondents said just 2 to 5 individuals are part of determining a vendor, which also highlights the intimacy and autonomy that most cloud buyers and buying committees have within their organizations.

- While it’s usually a speedy process, the top factors that can slow down the purchase process are major shifts within the cloud sector. Cloud buyers reported that major changes in the market environment (18%) or competitive assessment (18%) as the most common reasons for a purchase delay.

- 37% of cloud buyers said the average amount of time it takes to make a purchasing decision has increased somewhat over the past two years. Overall, cloud decision makers are feeling that their buying timeline is shifting to a slower pace. In the survey, 19% shared it’s increased significantly while 36% said it’s stayed the same, which reflects that buying efficiency isn’t improving.

While cloud purchasing decisions are generally streamlined by involving only a few key stakeholders, external factors are causing delays, and the overall decision-making time has slightly increased for many buyers over the past two years.

These trends reflect broader changes in the cloud market. Companies today are more strategic in their cloud investments, viewing cloud technologies as critical to their business operations and digital transformations. This shift may contribute to longer decision-making times as organizations weigh the long-term implications of their cloud investments.

The pressure on businesses to demonstrate a clear return on investment (ROI), particularly from AI and cloud technologies, is intensifying as well. A McKinsey & Company study projected that the cloud product category will grow by 10% next year, showing that companies will prioritize cloud technologies for their digital transformations.

The same study noted that 67% of enterprises expect to increase their spending on cloud products next year. However, this increase comes with added scrutiny and slower decision-making, as buyers are now more focused on security, privacy and the broader impact of these technologies on their business.

The complexity of the cloud landscape, combined with executive involvement in purchase decisions, further contributes to extended decision timelines as companies aim to ensure their investments align with long-term goals.

Bottom line: Cloud purchasing decisions have become more complex and slower as companies take a strategic approach, weighing long-term ROI, security and privacy concerns, with many businesses increasing their spending on cloud products but involving more scrutiny from key stakeholders.

2. Cloud Brand Perception Gets Established Quickly

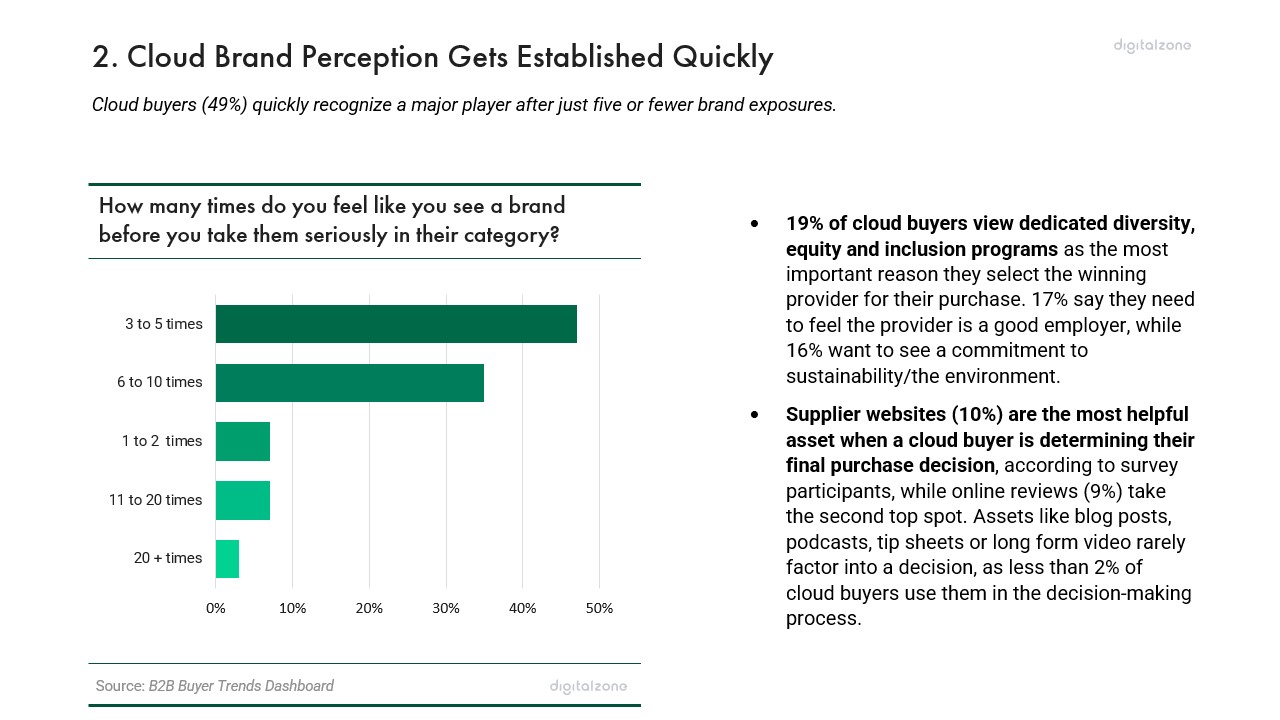

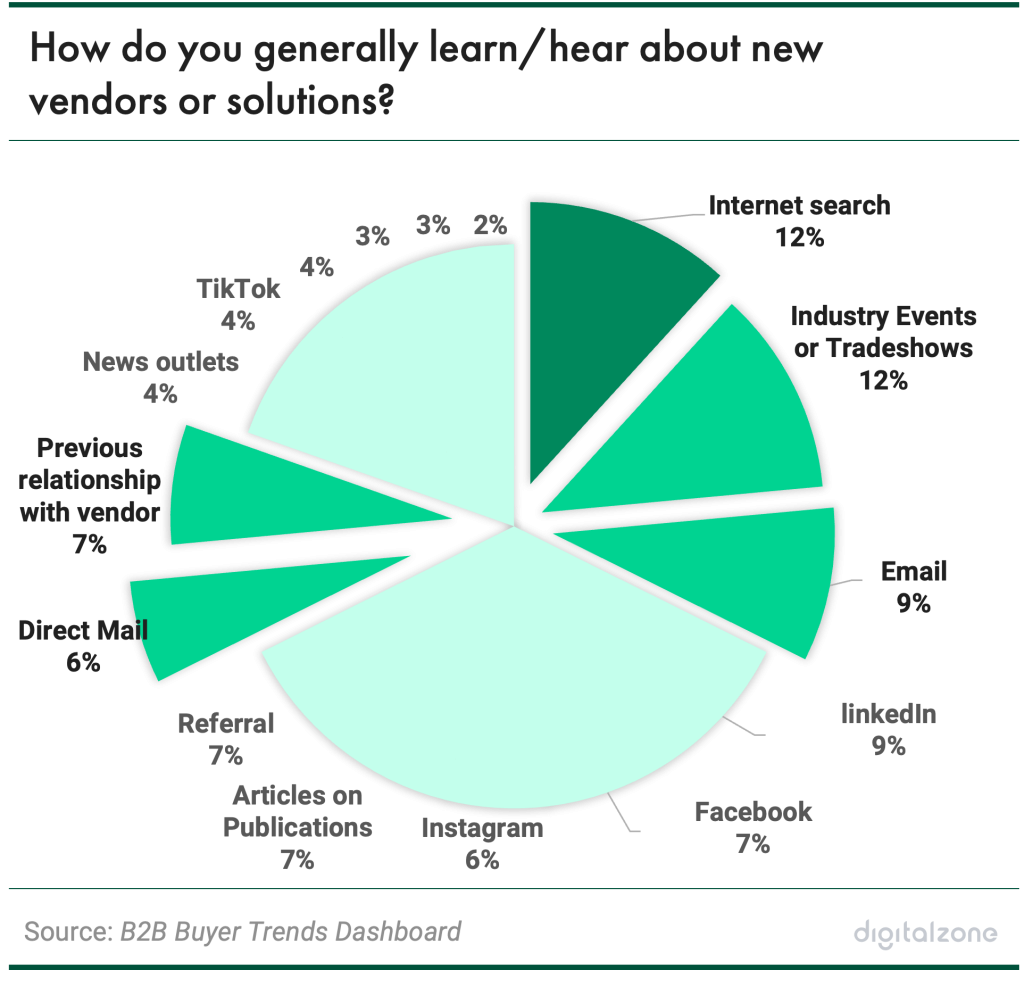

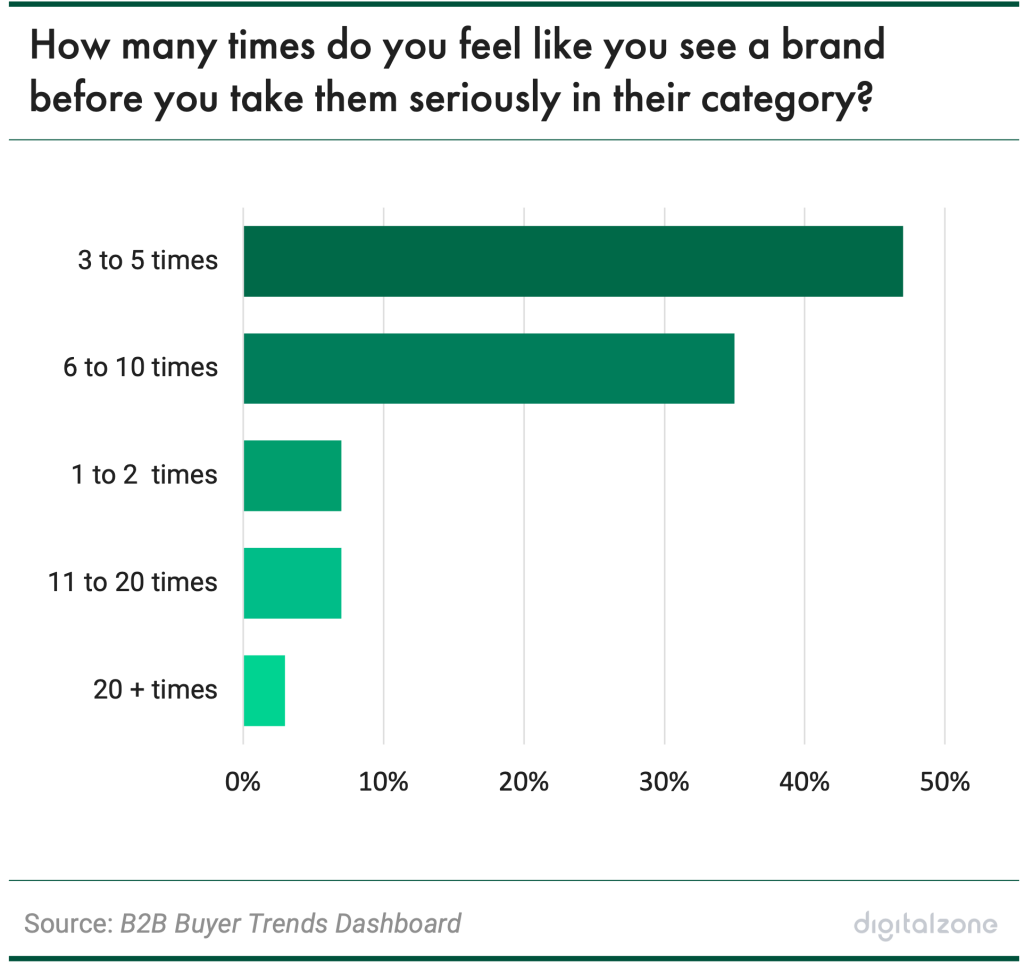

Cloud buyers (49%) quickly recognize a major player after just five or fewer brand exposures.

- 19% of cloud buyers view dedicated diversity, equity and inclusion programs as the most important reason they select the winning provider for their purchase. 17% say they need to feel the provider is a good employer, while 16% want to see a commitment to sustainability/the environment.

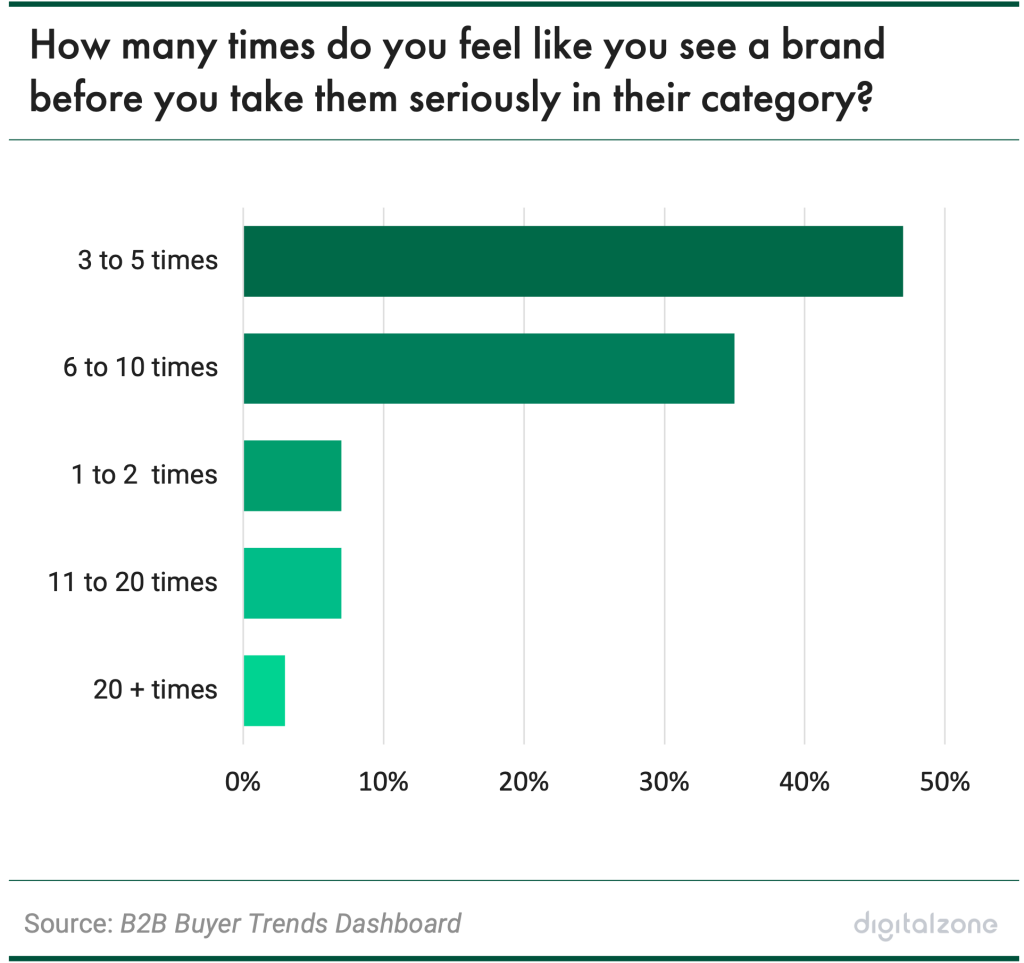

- Supplier websites (10%) are the most helpful asset when a cloud buyer is determining their final purchase decision, according to survey participants, while online reviews (9%) take the second top spot. Assets like blog posts, podcasts, tip sheets or long form video rarely factor into a decision, as less than 2% of cloud buyers use them in the decision-making process.

Cloud buyers are able to quickly determine if a brand should be taken seriously or not, which underscores their ability to form opinions quickly and with minimal influence.

Cloud buyers’ capacity to evaluate brands seriously and swiftly indicates a market where first impressions are important.

A Gartner report reveals that B2B buyers engage in a non-linear purchasing journey, frequently looping through stages of problem identification, solution exploration and supplier selection. In this context, brand familiarity can significantly influence their decision-making.

Buyers often rely on prior brand recognition to navigate complex purchasing processes, reinforcing the idea that effective branding can lead to quicker and more confident purchase decisions.

Additionally, the nature of the cloud market, characterized by rapid innovation and stiff competition, requires that brands establish strong recognition and credibility early in the buyer’s journey. Recognized brands tend to command higher trust and loyalty, making them more likely to be considered seriously by buyers.

According to Statista, the proportion of corporate data stored in the cloud has surged, which has already exceeded 60 percent by 2022—a significant jump from 30 percent in 2015. This upward trend also highlights the necessity for brands to build strong recognition and credibility since buyers need the upmost security and reliability with a vendor.

In our study, we additionally found cloud buyers typically prioritize supplier websites and online reviews over blog posts or long-form videos when making buying decisions. This preference shows the importance of providing accessible and clear information that directly addresses their concerns, especially since the abstract nature of cloud products is also more difficult to communicate.

Bottom line: Ultimately, brand exposure and recognition are crucial in the cloud sector, but vendors must communicate clearly, as buyers' quick assessments can greatly impact their purchasing decisions.

3. Cloud Buyers Want to Hear Directly from Vendors

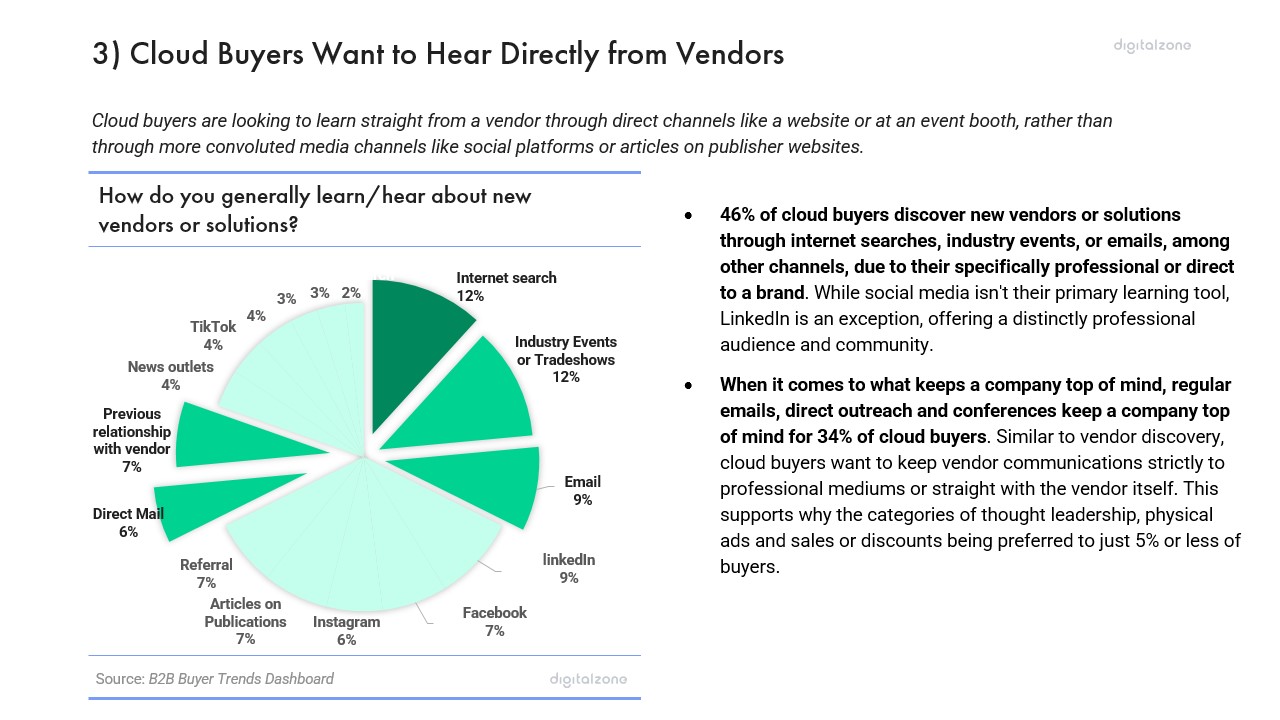

Cloud buyers are looking to learn straight from a vendor through direct channels like a website or at an event booth, rather than through more convoluted media channels like social platforms or articles on publisher websites.

- 46% of cloud buyers discover new vendors or solutions through internet searches, industry events, or emails, among other channels, due to their specifically professional or direct to a brand. While social media isn't their primary learning tool, LinkedIn is an exception, offering a distinctly professional audience and community.

- When it comes to what keeps a company top of mind, regular emails, direct outreach and conferences keep a company top of mind for 34% of cloud buyers. Similar to vendor discovery, cloud buyers want to keep vendor communications strictly to professional mediums or straight with the vendor itself. This supports why the categories of thought leadership, physical ads and sales or discounts being preferred to just 5% or less of buyers.

While media like social platforms and news outlets have their advantages, cloud buyers are increasingly looking to direct and informative channels to guide their vendor discovery process that can offer a more substantial evaluation.

Many cloud buyers prioritize concise and reliable sources of information when making purchasing decisions. This indicates a clear preference for actionable insights over the more casual, curated content often found on social media platforms or publications.

For marketing strategies overall, focusing on branded SEO may offer more impactful results compared to traditional PR in industry publications and news outlets.

Gartner highlights that B2B buyers in general value quick access to information that directly addresses their needs. This also shows why they engage with various digital interactions such as websites and interactive tools or experiences to guide their purchase decisions.

Bottom line: Cloud buyers are more and more preferring straightforward sources for discovering vendors. They want the space to make their own substantial evaluations without distractions from other topics, which is why internet search that leads to supplier websites, industry events or tradeshows, email, and other direct mediums with a brand prevail.

Final thoughts

When it comes to buying cloud solutions, B2B decision-makers such as IT managers, CTOs and CIOs make decisions that align with their organizational goals.

As businesses increasingly adopt multi-cloud and hybrid cloud strategies to optimize performance and mitigate vendor dependency, the demand for tailored and industry-specific solutions is on the rise. This underscores the importance of strong brand presence and credibility in this competitive space.

Cloud buyers are noticeably straightforward, too. They want to form opinions quickly and are turning to more direct sources of information. This shift highlights a preference for actionable insights coming straight from vendors.

The 2024 B2B Buyer Beat Dashboard sheds light on the critical trends that are shaping buyer behavior in the cloud market. As organizations navigate the complexities of digital transformation, understanding these cloud buyer trends will be important for both vendors and decision-makers alike.

Sources

A CTO’s Guide to Multicloud Computing — Gartner

Hybrid Cloud Market Research, 2032 — Allied Market Research

Capgemini

Global Healthcare Cloud Computing Market Growth, Share, Size, Trends and Forecast — ReAnIn

Key Findings from the 2024 Cloud Security Report — Fortinet

Executive Summary

- While 51% of cloud buyers report that their vendor selection process typically takes one to three months, the process is starting to take longer. External factors such as market shifts and competitive assessments are delaying the process. Notably, 37% of buyers have experienced a slight increase in decision-making time over the past two years, which reflects a growing strategic approach among companies as they emphasize long-term ROI and security concerns.

- Cloud buyers have a strong ability to quickly evaluate brands, with 49% able to recognize a major player after just five exposures. Supplier websites and online reviews emerge as top resources for buyers, showing the necessity for brands to establish strong recognition early in the purchasing journey.

- 44% of cloud buyers are discovering new vendors through direct channels, such as internet search, industry events, and email. This reveals a shift towards more immediate and reliable sources of information, and a move away from less direct methods such as social media and articles on web publications.